Page 6 - Longyard - Information Memorandum_Neat

P. 6

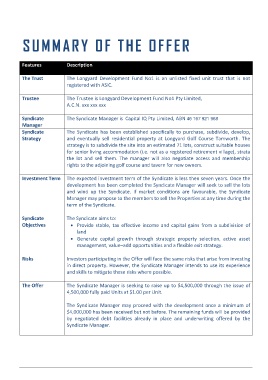

SUMMARY OF THE OFFER

th

Offer Timetable The Offer made in the Information Memorandum opens on 12 January 2017 and

is intended to close on the completion of capital raising. The Syndicate Manager

Features Description may close the Offer early or extend the offer period at its discretion and without

notice. Prospective Investors are encouraged to make their application early.

The Trust The Longyard Development Fund No1 is an unlisted fixed unit trust that is not

registered with ASIC. Minimum Minimum investment will be $250,000 and then in increments of $25,000,

Investment however, subscriptions below $250,000 will be considered subject to the discretion

Trustee The Trustee is Longyard Development Fund No1 Pty Limited, of the Syndicate Manager.

A.C.N. xxx xxx xxx

Distributions Once settled, distributions will be as and when available by direct deposit into

Syndicate The Syndicate Manager is Capital IQ Pty Limited, ABN 46 167 921 968 Investor’s nominated bank account(s). The forecast distribution information must

Manager be read in conjunction with the financial assumptions set out below and

Syndicate The Syndicate has been established specifically to purchase, subdivide, develop, information in Section 3 and the risk factors set out in Section 6 of the

Strategy and eventually sell residential property at Longyard Golf Course Tamworth. The supplementary material.

strategy is to subdivide the site into an estimated 71 lots, construct suitable houses

for senior living accommodation (i.e. not as a registered retirement village), strata Syndicate Upon closing the Offer it is the intention of the Syndicate Manager to enter into a

the lot and sell them. The manager will also negotiate access and membership Borrowing finance arrangement for development costs.

rights to the adjoining golf course and tavern for new owners.

Investors should be aware that the amount owing to the lenders ranks before an

Investment Term The expected investment term of the Syndicate is less then seven years. Once the investor’s interest in the Syndicate. All debt funding will be non–recourse to

development has been completed the Syndicate Manager will seek to sell the lots Investors – that is the lender will only have a claim against the development not

and wind up the Syndicate. If market conditions are favourable, the Syndicate against any Investor.

Manager may propose to the members to sell the Properties at any time during the

term of the Syndicate. Gearing The initial non-recourse bank facility will represent a maximum LVR of 50% of the

development value.

Syndicate The Syndicate aims to:

Objectives • Provide stable, tax effective income and capital gains from a subdivision of Related Party The Trustee has entered into (or will enter into) various related party transactions

land Transaction in relation to the management of the Trust and the Property including with Capital

• Generate capital growth through strategic property selection, active asset IQ Pty Limited for the syndicate management.

management, value–add opportunities and a flexible exit strategy.

Withdrawal Unlisted property trusts are illiquid investments. As such, Investors have no rights

Risks Investors participating in the Offer will face the same risks that arise from investing Rights to withdraw their investment during the term of the Syndicate. The Syndicate

in direct property. However, the Syndicate Manager intends to use its experience Manager however will assist investors should they wish to re-sell their holdings to

and skills to mitigate these risks where possible. existing or new investors (refer 1.8 in the Supplementary Material)

The Offer The Syndicate Manager is seeking to raise up to $4,500,000 through the issue of Regular Investors will receive quarterly updates on activities of the Syndicate, annual

4,500,000 fully paid Units at $1.00 per Unit. Reporting management reports and an annual tax statement.

The Syndicate Manager may proceed with the development once a minimum of Fees and Other Various fees and other costs are paid by the Syndicate to the Syndicate Manager

$4,000,000 has been received but not before. The remaining funds will be provided Costs and other parties that provide services to the Syndicate.

by negotiated debt facilities already in place and underwriting offered by the

Syndicate Manager. Cooling Off There is no cooling-off right for Investors because the Syndicate is not liquid.

Period

The above information is intended to be a summary only and should be read in conjunction with the

information appearing elsewhere in this Information Memorandum and the Supplementary Material. To

make an informed assessment of this offer, this Information Memorandum must be read in its entirety and,

in particular, Section 6 ‘Risk Factors’.