Page 33 - Laporan Tahunan KPP Pratama Palembang Ilir Barat 2015

P. 33

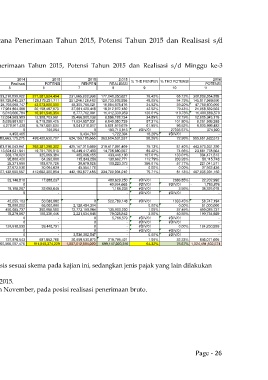

IV.4. Tabel Series Realisasi Penerimaan Tahun 2010 s/d 2014, Rencana Penerimaan Tahun 2015, Potensi Tahun 2015 dan Realisasi s/d

Minggu ke-3 November 2015.

Tabel 11 : Series Realisasi Penerimaan Tahun 2010 s/d 2014, Rencana Penerimaan Tahun 2015, Potensi Tahun 2015 dan Realisasi s/d Minggu ke-3

November 2015

2010 2011 2012 2013 2014 2015 2015 2,015 2016

No Jenis Pajak % THD RENPEN % THD POTENSI

Realisasi Realisasi Realisasi Realisasi Realisasi POTENSI RENPEN REALISASI POTENSI

1 2 1 2 3 4 5 6 7 8 9 10 11

1 PPh Non Migas

411121 - PPh Pasal 21 106,936,650,400 112,519,145,378 173,689,281,303 164,658,633,728 193,210,839,022 271,881,824,494 231,665,602,998 177,040,350,627 76.42% 65.12% 300,896,054,888

411128 - PPh Final & FLN 43,752,934,189 49,704,285,742 87,989,180,281 76,139,843,397 118,728,845,257 128,179,231,711 251,246,126,483 120,733,603,936 48.05% 94.19% 145,817,969,690

411126 - PPh Pasal 25/29 Badan 16,945,521,553 22,586,093,018 17,909,738,202 19,134,996,740 24,793,068,747 43,073,000,000 48,355,755,521 16,884,978,476 34.92% 39.20% 47,759,600,000

411124 - PPh Pasal 23 10,579,280,700 12,958,663,924 16,097,836,750 16,194,015,449 17,961,864,088 20,158,487,673 37,661,429,418 16,012,672,180 42.52% 79.43% 21,958,539,503

411125 - PPh Pasal 25/29 OP 4,379,635,083 4,211,354,328 5,007,361,282 5,984,597,590 6,010,666,784 10,301,546,354 8,777,762,001 11,412,330,959 130.01% 110.78% 11,400,889,570

411122 - PPh Pasal 22 11,607,384,034 9,971,355,176 11,397,196,971 12,083,395,424 12,034,569,983 12,308,703,961 25,466,900,136 8,886,188,734 34.89% 72.19% 12,605,345,176

411127 - PPh Pasal 26 16,765,619 41,559,101 36,314,584 4,421,776,932 5,639,951,501 6,719,250,426 11,934,957,531 6,840,050,739 57.31% 101.80% 8,281,909,385

411123 - PPh Pasal 22 Impor 314,972,816 620,036,748 2,755,387,461 4,023,336,002 4,278,911,428 5,797,881,834 9,041,216,817 5,601,919,679 61.96% 96.62% 6,930,999,482

411131 - PPh Final & FLN 3,885,143 0 159,181 4,456,950 0 706,254 0 190,713,813 #DIV/0! 27003.57% 374,920

411129 - PPh Non Migas Lainnya 287,876,014 34,435,190 16,680,200 0 4,458,465 - 9,434,760 1,722,394 18.26% #DIV/0! -

JUMLAH 194,824,905,551 212,646,928,605 314,899,136,215 302,645,052,212 382,663,175,275 498,420,632,707 624,159,185,665 363,604,531,537 58.26% 72.95% 555,651,682,613

2 PPN dan PPnBM

411211 - PPN Dalam Negeri 139,204,289,725 205,608,855,199 253,713,168,950 315,365,099,057 363,016,043,941 392,381,298,302 425,147,316,669 319,417,891,409 75.13% 81.40% 443,570,031,330

411212 - PPN Impor 595,999,934 1,709,368,234 7,924,581,972 15,252,839,726 13,624,631,941 19,701,705,013 16,449,417,403 14,708,680,557 89.42% 74.66% 23,661,778,564

411222 - PPnBM Impor 16,143,224 22,772,043 153,489,943 74,739,746 333,170,020 325,869,384 405,066,155 433,446,100 107.01% 133.01% 394,471,513

411221 - PPnBM Dalam Negeri 97,736,293 155,121,259 168,239,331 17,222,482 95,800,420 64,292,800 115,843,256 130,662,771 112.79% 203.23% 50,115,748

411219 - PPN Lainnya 46,476,092 15,479,487 1,066,950 377,396,725 25,371,699 189,070,726 30,679,826 109,223,373 356.01% 57.77% 221,041,571

411229 - PPnBM Lainnya 183,500 0 0 0 37,672,536 30,064,629 45,554,176 - 0.00% 0.00% 37,562,436

JUMLAH 139,960,828,768 207,511,596,222 261,960,547,146 331,087,297,736 377,132,690,557 412,692,300,854 442,193,877,485 334,799,904,210 75.71% 81.13% 467,935,001,162

3 PPh Migas

411111 - PPh Minyak Bumi 1,573,040 0 0 0 23,146,816 17,888,237 480,629,250 #DIV/0! 2686.85% 22,202,992

411119 - PPh Gas Alam Lainnya 8,615,925 42,500 1,070,500 3,845,245 0 - 40,994,665 #DIV/0! #DIV/0! - 1,780,876

411112 - PPh Gas Alam 468,180 6,828,551 26,879,054 25,812,664 19,108,287 32,698,645 1,165,233 #DIV/0! 3.56% 38,325,078

411113 - PPh Minyak Bumi Lainnya 0 0 0 0 0 - - #DIV/0! #DIV/0! -

Pendapatan atas PL dan PIB

JUMLAH 10,657,145 6,871,051 27,949,554 29,657,909 42,255,103 50,586,882 0 522,789,148 #DIV/0! 1033.45% 58,747,194

4 411611 - Bea Meterai 0 15,000,000 0 15,000,000 75,000,000 66,000,000 2,128,454,314 0.00% 0.00% 81,000,000

411622 - Bunga Penagihan PPN 0 0 0 0 450,085,737 360,068,590 12,773,159,064 135,000,000 1.06% 37.49% 450,085,737

411621 - Bunga Penagihan PPh 0 0 0 187,425,104 78,279,867 156,336,446 2,221,534,945 79,028,842 3.56% 50.55% 190,734,929

411624 - Bunga Penagihan PPN 0 0 0 0 0 - 0 5,766,579 #DIV/0! #DIV/0! -

411623 - Bunga Penagihan PPN 0 0 0 0 0 - 0 - #DIV/0! #DIV/0! -

411619 - Pajak Tidak Langsung Lainnya 600,000 0 0 0 124,610,939 99,448,751 0 - #DIV/0! 0.00% 124,250,939

411613 - PTLL 0 0 0 0 0 - 0 - #DIV/0! #DIV/0! -

411612 - Penjualan Benda Materai 0 0 0 0 0 - 3,536,382,547 - 0.00% #DIV/0! -

JUMLAH 600,000 15,000,000 0 202,425,104 727,976,543 681,853,786 20,659,530,870 219,795,421 1.06% 32.23% 846,071,605

TOTAL 334,796,991,464 420,180,395,878 576,887,632,915 633,964,432,961 760,566,097,478 911,845,374,229 1,087,012,594,020 699,147,020,316 64.32% 76.67% 1,024,491,502,574

Catatan :

1. Pada kolom (7) Potensi, field dengan highlight kuning adalah hasil analisis sesuai skema pada kajian ini, sedangkan jenis pajak yang lain dilakukan

analisa Trend dari Tahun 2010 s/d 2014.

2. Pada kolom (11) Potensi Tahun 2016 diestimasi dengan trend 2010 s/d 2015.

3. Data Realisasi Tahun 2015 terhitung sampai dengan minggu ke-3 bulan November, pada posisi realisasi penerimaan bruto.

Page - 26