Page 39 - Laporan Tahunan KPP Pratama Palembang Ilir Barat 2015

P. 39

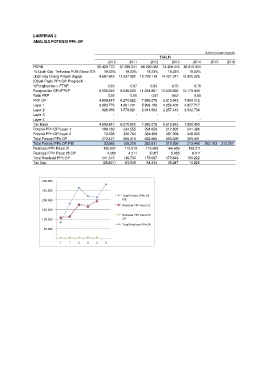

LAMPIRAN 2

ANALISA POTENSI PPh OP

dalam jutaan rupiah

TAHUN

2010 2011 2012 2013 2014 2015 2016

PDRB 50.429.770 57.398.241 66.090.062 73.329.416 82.815.004

% Upah Gaji Terhadap PDB (Base 2010) 19,23% 19,23% 19,23% 19,23% 19,23%

Upah Gaji Orang Pribadi (Ugop) 9.697.645 11.037.682 12.709.119 14.101.247 15.925.325

(Objek Pajak PPh OP Progresif)

%Penghasilan > PTKP 0,83 0,87 0,93 0,75 0,76

Penghasilan OP>PTKP 8.085.848 9.548.020 11.834.861 10.538.630 12.179.449

Ratio PKP 0,59 0,66 0,67 0,62 0,65

PKP OP 4.809.847 6.270.922 7.935.078 6.513.843 7.894.112

Layer 1 3.983.779 4.691.101 5.893.185 4.256.400 4.827.717

Layer 2 826.068 1.579.821 2.041.893 2.257.443 3.002.734

Layer 3 - - - - -

Layer 4 - - - - -

Tax Base 4.809.847 6.270.922 7.935.078 6.513.843 7.830.450

Potensi PPh OP Layer 1 199.189 234.555 294.659 212.820 241.386

Potensi PPh OP Layer 2 73.238 330.764 339.309 381.009 348.005

Total Potensi PPh OP 272.427 565.319 633.968 593.829 589.391

Total Potensi PPh OP PIB 82.685 180.279 262.911 219.890 213.448 282.183 312.297

Realisasi PPh Pasal 21 106.937 112.519 173.689 164.659 193.211

Realisasi PPh Pasal 25 OP 4.380 4.211 5.007 5.985 6.011

Total Realisasi PPh OP 111.316 116.730 178.697 170.643 199.222

Tax Gap (28.631) 63.549 84.214 49.247 14.226

300.000

250.000

Total Potensi PPh OP

200.000 PIB

Realisasi PPh Pasal 21

150.000

Realisasi PPh Pasal 25

100.000 OP

Total Realisasi PPh OP

50.000

-

1 2 3 4 5 6