Page 12 - VTax Ownership Package New

P. 12

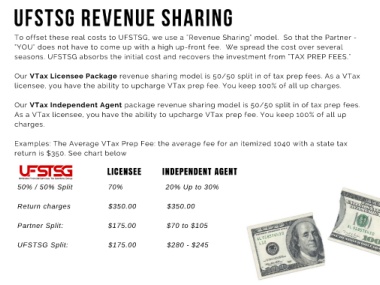

UFSTSG REVENUE SHARING

To offset these real costs to UFSTSG, we use a "Revenue Sharing" model. So that the Partner -

"YOU" does not have to come up with a high up-front fee. We spread the cost over several

seasons. UFSTSG absorbs the initial cost and recovers the investment from "TAX PREP FEES."

Our VTax Licensee Package revenue sharing model is 50/50 split in of tax prep fees. As a VTax

licensee, you have the ability to upcharge VTax prep fee. You keep 100% of all up charges.

Our VTax Independent Agent package revenue sharing model is 50/50 split in of tax prep fees.

As a VTax licensee, you have the ability to upcharge VTax prep fee. You keep 100% of all up

charges.

Examples: The Average VTax Prep Fee: the average fee for an itemized 1040 with a state tax

return is $350. See chart below

LICENSEE INDEPENDENT AGENT

50% / 50% Split 70% 20% Up to 30%

Return charges $350.00 $350.00

Partner Split: $175.00 $70 to $105

UFSTSG Split: $175.00 $280 - $245