Page 14 - VTax Ownership Package New

P. 14

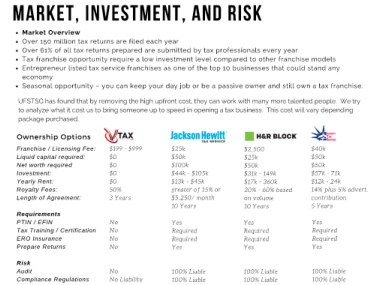

MARKET, INVESTMENT, AND RISK

Market Overview

Over 150 million tax returns are filed each year

Over 61% of all tax returns prepared are submitted by tax professionals every year

Tax franchise opportunity require a low investment level compared to other franchise models

Entrepreneur listed tax service franchises as one of the top 10 businesses that could stand any

economy

Seasonal opportunity – you can keep your day job or be a passive owner and still own a tax franchise.

UFSTSG has found that by removing the high upfront cost, they can work with many more talented people. We try

to analyze what it cost us to bring someone up to speed in opening a tax business. This cost will vary depending

package purchased.

O w n e r s h i p O p t i o n s

Franchise / Licensing Fee:

$ 2 5 k

$ 1 9 9 - $ 9 9 9

$ 2 , 5 0 0 $ 4 0 k

Liquid capital required: $ 0 $ 5 0 k $ 2 5 k $ 5 0 k

Net worth required

$ 1 0 0 k

$ 0

$ 5 0 k $ 5 0 k

Investment: $ 0 $ 4 4 k - $ 1 0 5 k $ 3 1 k - 1 4 9 k $ 5 7 k - 7 1 k

Yearly Rent:

$ 1 3 k - $ 4 5 k

$ 0

$ 1 7 k - 3 6 0 k $ 1 2 k - 2 4 k

Royalty Fees: 5 0 % g r e a t e r o f 1 5 % o r 2 0 % - 6 0 % b a s e d 1 4 % p l u s 5 % a d v e r t .

Length of Agreement:

3 Y e a r s

$ 5 , 2 5 0 / m o n t h

o n v o l u m e c o n t r i b u t i o n

1 0 Y e a r s 1 0 Y e a r s 5 Y e a r s

Requirements

PTIN / EFIN N o Y e s Y e s Y e s

Tax Training / Certification

N o

R e q u i r e d R e q u i r e d R e q u i r e d

ERO Insurance N o R e q u i r e d R e q u i r e d R e q u i r e d

Prepare Returns

N o

Y e s Y e s Y e s

Risk

Audit N o 1 0 0 % L i a b l e 1 0 0 % L i a b l e 1 0 0 % L i a b l e

Compliance Regulations

N o L i a b i l i t y

1 0 0 % L i a b l e 1 0 0 % L i a b l e 1 0 0 % L i a b l e