Page 207 - 2019 Orientation Manual

P. 207

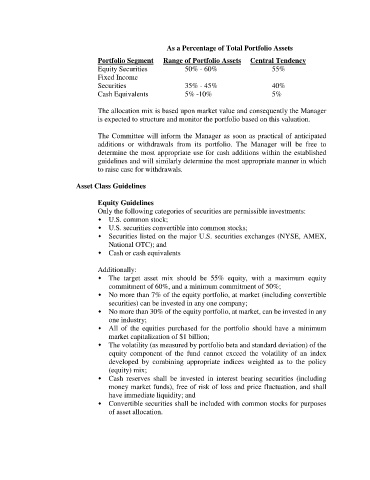

As a Percentage of Total Portfolio Assets

Portfolio Segment Range of Portfolio Assets Central Tendency

Equity Securities 50% - 60% 55%

Fixed Income

Securities 35% - 45% 40%

Cash Equivalents 5% -10% 5%

The allocation mix is based upon market value and consequently the Manager

is expected to structure and monitor the portfolio based on this valuation.

The Committee will inform the Manager as soon as practical of anticipated

additions or withdrawals from its portfolio. The Manager will be free to

determine the most appropriate use for cash additions within the established

guidelines and will similarly determine the most appropriate manner in which

to raise case for withdrawals.

Asset Class Guidelines

Equity Guidelines

Only the following categories of securities are permissible investments:

U.S. common stock;

U.S. securities convertible into common stocks;

Securities listed on the major U.S. securities exchanges (NYSE, AMEX,

National OTC); and

Cash or cash equivalents

Additionally:

The target asset mix should be 55% equity, with a maximum equity

commitment of 60%, and a minimum commitment of 50%;

No more than 7% of the equity portfolio, at market (including convertible

securities) can be invested in any one company;

No more than 30% of the equity portfolio, at market, can be invested in any

one industry;

All of the equities purchased for the portfolio should have a minimum

market capitalization of $1 billion;

The volatility (as measured by portfolio beta and standard deviation) of the

equity component of the fund cannot exceed the volatility of an index

developed by combining appropriate indices weighted as to the policy

(equity) mix;

Cash reserves shall be invested in interest bearing securities (including

money market funds), free of risk of loss and price fluctuation, and shall

have immediate liquidity; and

Convertible securities shall be included with common stocks for purposes

of asset allocation.