Page 16 - Test1

P. 16

RETIREMENT PLANS

As an employee of the City of Raleigh, you are provided retirement benefits through the Local Governmental Employee’s Retirement System (LGERS).

Pension

The City of Raleigh Pension Plan offers an easy way to save for your future through payroll deductions.

Eligibility

You are eligible to participate in the plan as outlined below. You are automatically enrolled to participate.

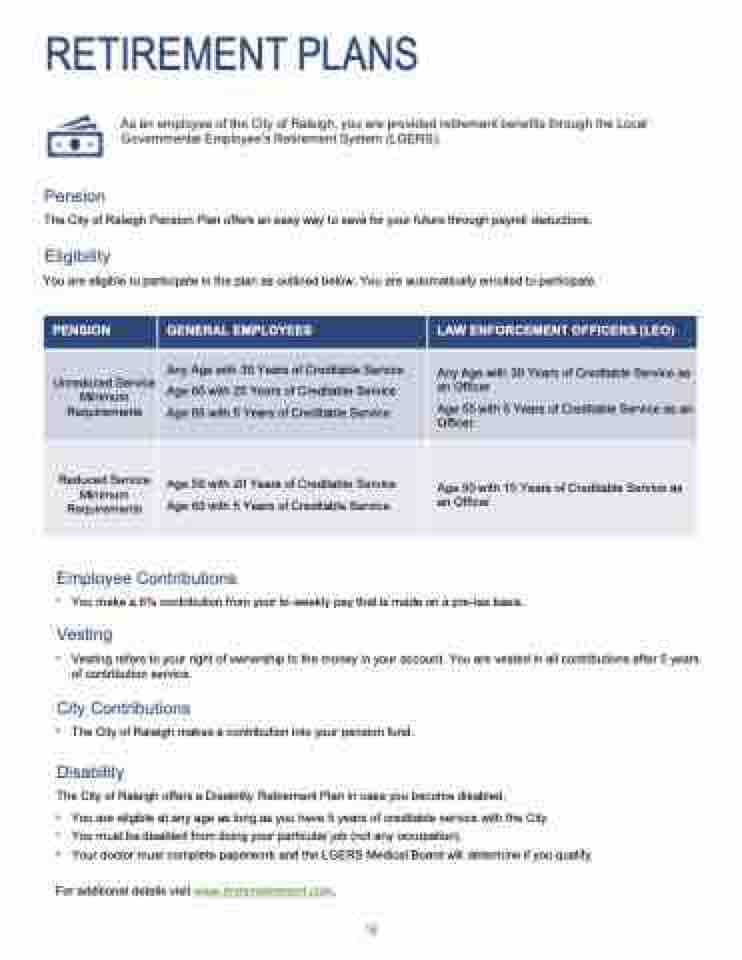

PENSION

GENERAL EMPLOYEES

LAW ENFORCEMENT OFFICERS (LEO)

Unreduced Service Minimum Requirements

Any Age with 30 Years of Creditable Service Age 60 with 25 Years of Creditable Service Age 65 with 5 Years of Creditable Service

Any Age with 30 Years of Creditable Service as an Officer

Age 55 with 5 Years of Creditable Service as an Officer

Reduced Service Minimum Requirements

Age 50 with 20 Years of Creditable Service Age 60 with 5 Years of Creditable Service

Age 50 with 15 Years of Creditable Service as an Officer

Employee Contributions

• You make a 6% contribution from your bi-weekly pay that is made on a pre-tax basis. Vesting

• Vesting refers to your right of ownership to the money in your account. You are vested in all contributions after 5 years of contribution service.

City Contributions

• The City of Raleigh makes a contribution into your pension fund.

Disability

The City of Raleigh offers a Disability Retirement Plan in case you become disabled.

• You are eligible at any age as long as you have 5 years of creditable service with the City.

• You must be disabled from doing your particular job (not any occupation).

• Your doctor must complete paperwork and the LGERS Medical Board will determine if you qualify.

For additional details visit www.myncretirement.com.

16