Page 17 - Test1

P. 17

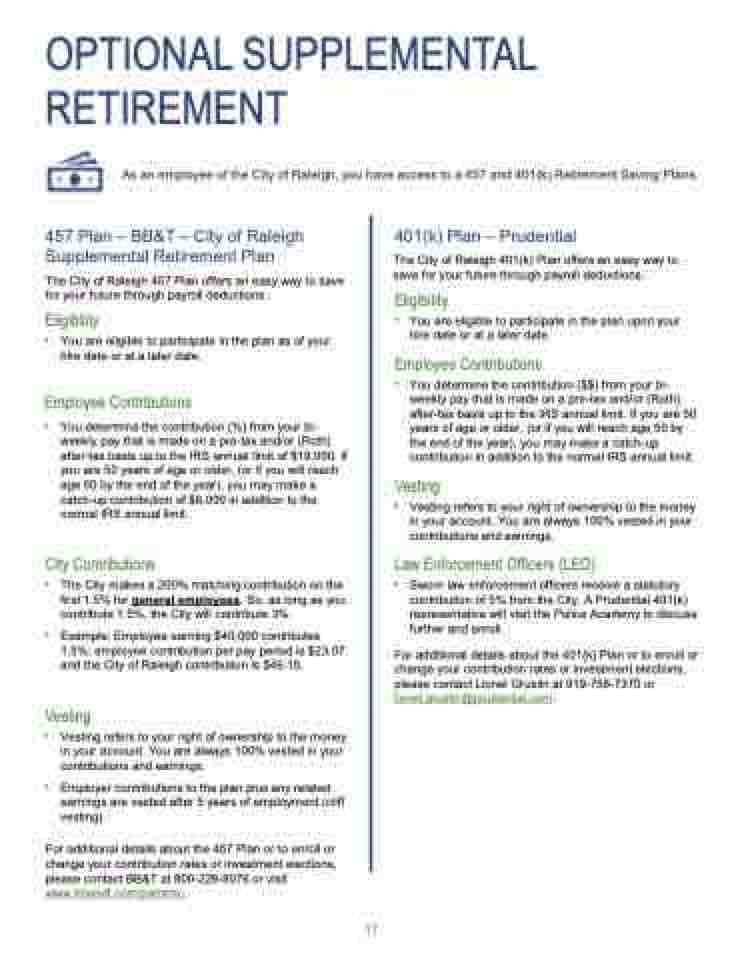

OPTIONAL SUPPLEMENTAL RETIREMENT

As an employee of the City of Raleigh, you have access to a 457 and 401(k) Retirement Saving Plans.

457 Plan – BB&T – City of Raleigh Supplemental Retirement Plan

The City of Raleigh 457 Plan offers an easy way to save for your future through payroll deductions.

Eligibility

• You are eligible to participate in the plan as of your hire date or at a later date.

Employee Contributions

• You determine the contribution (%) from your bi- weekly pay that is made on a pre-tax and/or (Roth) after-tax basis up to the IRS annual limit of $19,000. If you are 50 years of age or older, (or if you will reach age 50 by the end of the year), you may make a catch-up contribution of $6,000 in addition to the normal IRS annual limit.

City Contributions

• The City makes a 200% matching contribution on the first 1.5% for general employees. So, as long as you contribute 1.5%, the City will contribute 3%.

• Example: Employee earning $40,000 contributes 1.5%; employee contribution per pay period is $23.07 and the City of Raleigh contribution is $46.15.

Vesting

• Vesting refers to your right of ownership to the money in your account. You are always 100% vested in your contributions and earnings.

• Employer contributions to the plan plus any related earnings are vested after 5 years of employment (cliff vesting).

For additional details about the 457 Plan or to enroll or change your contribution rates or investment elections, please contact BB&T at 800-228-8076 or visit www.bbandt.com/palntrac.

401(k) Plan – Prudential

The City of Raleigh 401(k) Plan offers an easy way to save for your future through payroll deductions.

Eligibility

• You are eligible to participate in the plan upon your hire date or at a later date.

Employee Contributions

• You determine the contribution ($$) from your bi- weekly pay that is made on a pre-tax and/or (Roth) after-tax basis up to the IRS annual limit. If you are 50 years of age or older, (or if you will reach age 50 by the end of the year), you may make a catch-up contribution in addition to the normal IRS annual limit.

Vesting

• Vesting refers to your right of ownership to the money in your account. You are always 100% vested in your contributions and earnings.

Law Enforcement Officers (LEO)

• Sworn law enforcement officers receive a statutory contribution of 5% from the City. A Prudential 401(k) representative will visit the Police Academy to discuss further and enroll.

For additional details about the 401(k) Plan or to enroll or change your contribution rates or investment elections, please contact Lionel Gruslin at 919-758-7370 or lionel.gruslin@prudential.com.

17