Page 340 - Department of Social Development Annual Report 2021

P. 340

PART E: FINANCIAL INFORMATION

REFUGEE RELIEF FUND

Notes To The Financial Statements Of The Refugee Relief Fund For The Year Ended

31 March 2021.

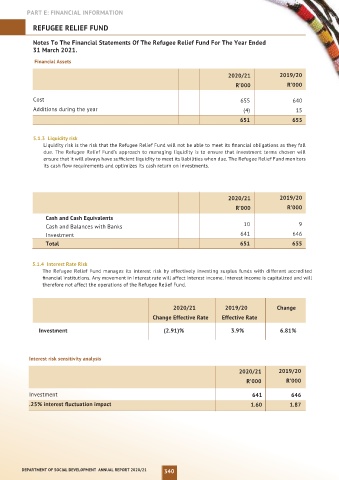

Financial Assets

2020/21 2019/20

R’000 R’000

Cost 655 640

Additions during the year (4) 15

Closing Balance 651 655

5.1.3 Liquidity risk

Liquidity risk is the risk that the Refugee Relief Fund will not be able to meet its financial obligations as they fall

due. The Refugee Relief Fund’s approach to managing liquidity is to ensure that investment terms chosen will

ensure that it will always have sufficient liquidity to meet its liabilities when due. The Refugee Relief Fund monitors

its cash flow requirements and optimizes its cash return on investments.

2020/21 2019/20

R’000 R’000

Cash and Cash Equivalents

Cash and Balances with Banks 10 9

Investment 641 646

Total 651 655

5.1.4 Interest Rate Risk

The Refugee Relief Fund manages its interest risk by effectively investing surplus funds with different accredited

financial institutions. Any movement in interest rate will affect interest income. Interest income is capitalized and will

therefore not affect the operations of the Refugee Relief Fund.

2020/21 2019/20 Change

Change Effective Rate Effective Rate

Investment (2.91)% 3.9% 6.81%

Interest risk sensitivity analysis

2020/21 2019/20

R’000 R’000

Investment 641 646

.25% interest fluctuation impact 1.60 1.87

DEPARTMENT OF SOCIAL DEVELOPMENT ANNUAL REPORT 2020/21 340