Page 366 - Department of Social Development Annual Report 2021

P. 366

PART E: FINANCIAL INFORMATION

STATE PRESIDENT FUND

Notes To The Financial Statements Of The State President Fund For The Year Ended

31 March 2021.

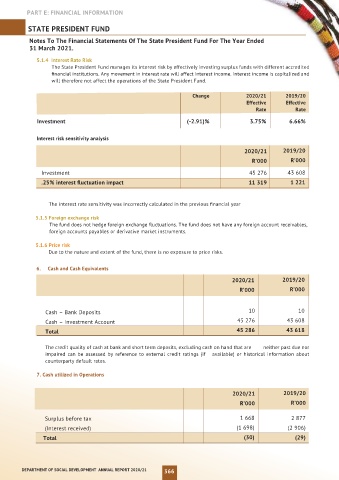

5.1.4 Interest Rate Risk

The State President Fund manages its interest risk by effectively investing surplus funds with different accredited

financial institutions. Any movement in interest rate will affect interest income. Interest income is capitalized and

will therefore not affect the operations of the State President Fund.

Change 2020/21 2019/20

Effective Effective

Rate Rate

Investment (-2.91)% 3.75% 6.66%

Interest risk sensitivity analysis

2019/20

2020/21 2020/21 2019/20

R’000 R’000 R’000 R’000

Investment 45 276 43 608

.25% interest fluctuation impact 11 319 1 221

The interest rate sensitivity was incorrectly calculated in the previous financial year

5.1.5 Foreign exchange risk

The fund does not hedge foreign exchange fluctuations. The fund does not have any foreign account receivables,

foreign accounts payables or derivative market instruments.

5.1.6 Price risk

Due to the nature and extent of the fund, there is no exposure to price risks.

6. Cash and Cash Equivalents

6. Cash and Cash Equivalents

2020/21 2019/20

R’000 R’000

Cash – Bank Deposits 10 10

Cash – Investment Account 45 276 43 608

Total 45 286 43 618

The credit quality of cash at bank and short term deposits, excluding cash on hand that are neither past due nor

impaired can be assessed by reference to external credit ratings (if available) or historical information about

counterparty default rates.

7. Cash utilized in Operations

2020/21 2019/20

R’000 R’000

Surplus before tax 1 668 2 877

(Interest received) (1 698) (2 906)

Total (30) (29)

DEPARTMENT OF SOCIAL DEVELOPMENT ANNUAL REPORT 2020/21 366