Page 20 - Work Life and Benefits Booklet 2018 - SW.pub

P. 20

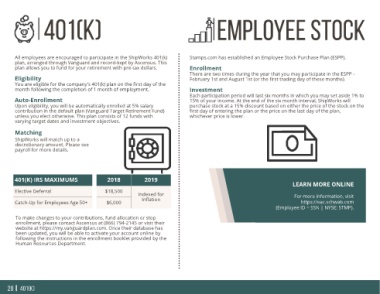

EMPLOYEE STOCK

purchase stock at a 15% discount based on either the price of the stock on the

Each participation period will last six months in which you may set aside 1% to

There are two times during the year that you may participate in the ESPP -

LEARN MORE ONLINE For more information, visit https://eac.schwab.com (Employee ID = SSN | NYSE: STMP).

15% of your income. At the end of the six month interval, ShipWorks will

Stamps.com has established an Employee Stock Purchase Plan (ESPP).

February 1st and August 1st (or the first trading day of these months).

first day of entering the plan or the price on the last day of the plan,

Enrollment Investment whichever price is lower.

2019 Indexed for Inflation

2018 $18,500 $6,000

401(k) All employees are encouraged to participate in the ShipWorks 401(k) plan, arranged through Vanguard and record-kept by Ascensus. This plan allows you to fund for your retirement with pre-tax dollars. You are eligible for the company's 401(k) plan on the first day of the month following the completion of 1 month of employment. Upon eligibility, you will be automatically enrolled at 5% salary contribution in the default plan (Vanguard Target Retirement

Eligibility Auto-Enrollment Matching ShipWorks will match up to a payroll for more details. 401(K) IRS MAXIMUMS Elective Deferral 401(k)

20