Page 20 - WesternU Sample Guide

P. 20

Retirement Savings

Vanguard | 401(k)

You are encouraged to participate in Acorns’s 401(k) plan. This plan allows you to fund your retirement with pre-tax dollars. You

can defer up to 75% of your annual salary to the 2019 IRS benefit maximum. If you are 50 years old or older during the plan year,

you may contribute a catch-up deferral.

Eligibility

You are eligible for the company’s 401(k) plan on the first day of the month following the completion of 1 month of employment.

Auto-Enrollment

Upon eligibility, you will be automatically enrolled at 5% (pre-tax) salary contribution unless you elect otherwise. This plan consists

of 12 funds with varying target dates and investment objectives.

Matching

Acorns will match up to a discretionary amount. Add additional details here.

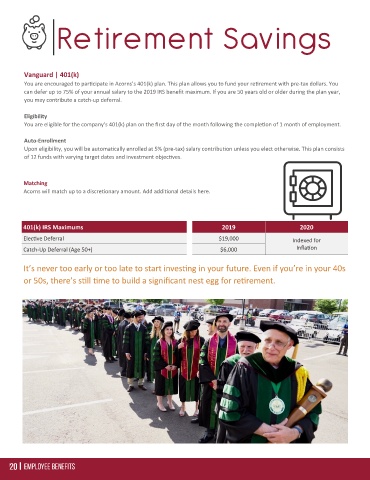

401(k) IRS Maximums 2019 2020

Elective Deferral $19,000 Indexed for

Catch-Up Deferral (Age 50+) $6,000 Inflation

It’s never too early or too late to start investing in your future. Even if you’re in your 40s

or 50s, there’s still time to build a significant nest egg for retirement.