Page 7 - Veritone's EE Guide final

P. 7

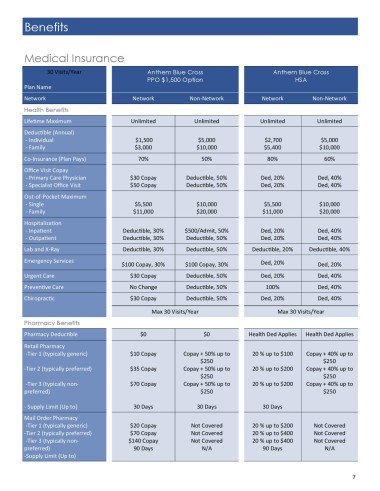

Benefits

Medical Insurance

30 Visits/Year Anthem Blue Cross Anthem Blue Cross

PPO $1,500 Option HSA

Plan Name

Network Network Non-Network Network Non-Network

Health Benefits

Lifetime Maximum Unlimited Unlimited Unlimited Unlimited

Deductible (Annual)

- Individual $1,500 $5,000 $2,700 $5,000

- Family $3,000 $10,000 $5,400 $10,000

Co-Insurance (Plan Pays) 70% 50% 80% 60%

Office Visit Copay

- Primary Care Physician $30 Copay Deductible, 50% Ded, 20% Ded, 40%

- Specialist Office Visit $50 Copay Deductible, 50% Ded, 20% Ded, 40%

Out-of-Pocket Maximum

- Single $5,500 $10,000 $5,500 $10,000

- Family $11,000 $20,000 $11,000 $20,000

Hospitalization

- Inpatient Deductible, 30% $500/Admit, 50% Ded, 20% Ded, 40%

- Outpatient Deductible, 30% Deductible, 50% Ded, 20% Ded, 40%

Lab and X-Ray Deductible, 30% Deductible, 50% Deductible, 20% Deductible, 40%

Emergency Services Ded, 20%

$100 Copay, 30% $100 Copay, 30% Ded, 20%

Urgent Care $30 Copay Deductible, 50% Ded, 20% Ded, 40%

Preventive Care No Change Deductible, 50% 100% Ded, 40%

Chiropractic $30 Copay Deductible, 50% Ded, 20% Ded, 40%

Max 30 Visits/Year Max 30 Visits/Year

Pharmacy Benefits

Pharmacy Deductible $0 $0 Health Ded Applies Health Ded Applies

Retail Pharmacy

-Tier 1 (typically generic) $10 Copay Copay + 50% up to 20 % up to $100 Copay + 40% up to

$250 $250

-Tier 2 (typically preferred) $35 Copay Copay + 50% up to 20 % up to $200 Copay + 40% up to

$250 $250

-Tier 3 (typically non- $70 Copay Copay + 50% up to 20 % up to $200 Copay + 40% up to

preferred) $250 $250

- Supply Limit (Up to) 30 Days 30 Days 30 Days

Mail Order Pharmacy

-Tier 1 (typically generic) $20 Copay Not Covered 20 % up to $200 Not Covered

-Tier 2 (typically preferred) $70 Copay Not Covered 20 % up to $400 Not Covered

-Tier 3 (typically non- $140 Copay Not Covered 20 % up to $400 Not Covered

preferred) 90 Days N/A 90 Days N/A

-Supply Limit (Up to)

7