Page 19 - FSSI EE Guide 07-20 - CA

P. 19

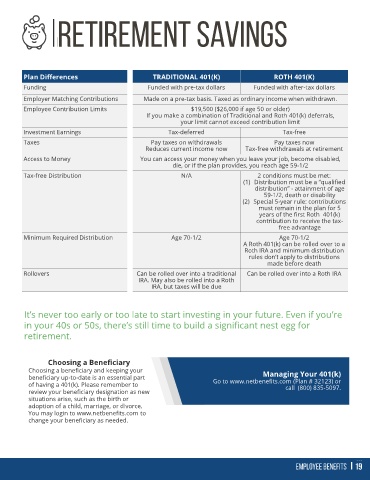

Plan Differences TRADITIONAL 401(K) ROTH 401(K)

Funding Funded with pre-tax dollars Funded with after-tax dollars

Employer Matching Contributions Made on a pre-tax basis. Taxed as ordinary income when withdrawn.

Employee Contribution Limits $19,500 ($26,000 if age 50 or older)

If you make a combination of Traditional and Roth 401(k) deferrals,

your limit cannot exceed contribution limit

Investment Earnings Tax-deferred Tax-free

Taxes Pay taxes on withdrawals Pay taxes now

Reduces current income now Tax-free withdrawals at retirement

Access to Money You can access your money when you leave your job, become disabled,

die, or if the plan provides, you reach age 59-1/2

Tax-free Distribution N/A 2 conditions must be met:

(1) Distribution must be a “qualified

distribution” - attainment of age

59-1/2, death or disability

(2) Special 5-year rule: contributions

must remain in the plan for 5

years of the first Roth 401(k)

contribution to receive the tax-

free advantage

Minimum Required Distribution Age 70-1/2 Age 70-1/2

A Roth 401(k) can be rolled over to a

Roth IRA and minimum distribution

rules don’t apply to distributions

made before death

Rollovers Can be rolled over into a traditional Can be rolled over into a Roth IRA

IRA. May also be rolled into a Roth

IRA, but taxes will be due

It’s never too early or too late to start investing in your future. Even if you’re

in your 40s or 50s, there’s still time to build a significant nest egg for

retirement.

Choosing a Beneficiary

Choosing a beneficiary and keeping your Managing Your 401(k)

beneficiary up-to-date is an essential part

of having a 401(k). Please remember to Go to www.netbenefits.com (Plan # 32123) or

call (800) 835-5097.

review your beneficiary designation as new

situations arise, such as the birth or

adoption of a child, marriage, or divorce.

You may login to www.netbenefits.com to

change your beneficiary as needed.