Page 7 - Confie Benefits Guide

P. 7

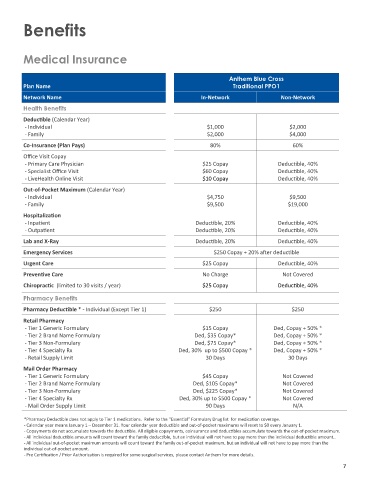

Benefits

Medical Insurance

Anthem Blue Cross

Plan Name Traditional PPO1

Network Name In-Network Non-Network

Health Benefits

Deductible (Calendar Year)

- Individual $1,000 $2,000

- Family $2,000 $4,000

Co-Insurance (Plan Pays) 80% 60%

Office Visit Copay

- Primary Care Physician $25 Copay Deductible, 40%

- Specialist Office Visit $60 Copay Deductible, 40%

- LiveHealth Online Visit $10 Copay Deductible, 40%

Out-of-Pocket Maximum (Calendar Year)

- Individual $4,750 $9,500

- Family $9,500 $19,000

Hospitalization

- Inpatient Deductible, 20% Deductible, 40%

- Outpatient Deductible, 20% Deductible, 40%

Lab and X-Ray Deductible, 20% Deductible, 40%

Emergency Services $250 Copay + 20% after deductible

Urgent Care $25 Copay Deductible, 40%

Preventive Care No Charge Not Covered

Chiropractic (limited to 30 visits / year) $25 Copay Deductible, 40%

Pharmacy Benefits

Pharmacy Deductible * - Individual (Except Tier 1) $250 $250

Retail Pharmacy

- Tier 1 Generic Formulary $15 Copay Ded, Copay + 50% *

- Tier 2 Brand Name Formulary Ded, $35 Copay* Ded, Copay + 50% *

- Tier 3 Non-Formulary Ded, $75 Copay* Ded, Copay + 50% *

- Tier 4 Specialty Rx Ded, 30% up to $500 Copay * Ded, Copay + 50% *

- Retail Supply Limit 30 Days 30 Days

Mail Order Pharmacy

- Tier 1 Generic Formulary $45 Copay Not Covered

- Tier 2 Brand Name Formulary Ded, $105 Copay* Not Covered

- Tier 3 Non-Formulary Ded, $225 Copay* Not Covered

- Tier 4 Specialty Rx Ded, 30% up to $500 Copay * Not Covered

- Mail Order Supply Limit 90 Days N/A

*Pharmacy Deductible does not apply to Tier 1 medications. Refer to the “Essential” Formulary Drug list for medication coverage.

- Calendar year means January 1 – December 31. Your calendar year deductible and out-of-pocket maximums will reset to $0 every January 1.

- Copayments do not accumulate towards the deductible. All eligible copayments, coinsurance and deductibles accumulate towards the out-of-pocket maximum.

- All individual deductible amounts will count toward the family deductible, but an individual will not have to pay more than the individual deductible amount..

- All individual out-of-pocket maximum amounts will count toward the family out-of-pocket maximum, but an individual will not have to pay more than the

individual out-of-pocket amount.

- Pre Certification / Prior Authorization is required for some surgical services, please contact Anthem for more details.

7