Page 13 - Oremor Benefits Flipbook

P. 13

Benefits

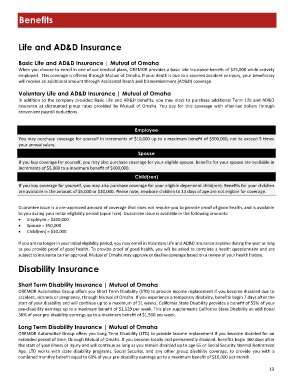

Life and AD&D Insurance

Basic Life and AD&D Insurance | Mutual of Omaha

When you choose to enroll in one of our medical plans, OREMOR provides a basic Life insurance benefit of $25,000 while actively

employed. This coverage is offered through Mutual of Omaha. If your death is due to a covered accident or injury, your beneficiary

will receive an additional amount through Accidental Death and Dismemberment (AD&D) coverage.

Voluntary Life and AD&D Insurance | Mutual of Omaha

In addition to the company provided Basic Life and AD&D benefits, you may elect to purchase additional Term Life and AD&D

insurance at discounted group rates provided by Mutual of Omaha. You pay for this coverage with after-tax dollars through

convenient payroll deductions.

Employee

You may purchase coverage for yourself in increments of $10,000 up to a maximum benefit of $500,000, not to exceed 5 times

your annual salary.

Spouse

If you buy coverage for yourself, you may also purchase coverage for your eligible spouse. Benefits for your spouse are available in

increments of $5,000 to a maximum benefit of $100,000.

Child(ren)

If you buy coverage for yourself, you may also purchase coverage for your eligible dependent child(ren). Benefits for your children

are available in the amount of $5,000 or $10,000. Please note, newborn children to 13 days of age are not eligible for coverage.

Guarantee issue is a pre-approved amount of coverage that does not require you to provide proof of good health, and is available

to you during your initial eligibility period (upon hire). Guarantee issue is available in the following amounts:

Employee = $200,000

Spouse = $50,000

Child(ren) = $10,000

If you are no longer in your initial eligibility period, you may enroll in Voluntary Life and AD&D insurance anytime during the year as long

as you provide proof of good health. To provide proof of good health, you will be asked to complete a health questionnaire and are

subject to insurance carrier approval. Mutual of Omaha may approve or decline coverage based on a review of your health history.

Disability Insurance

Short Term Disability Insurance | Mutual of Omaha

OREMOR Automotive Group offers you Short Term Disability (STD) to provide income replacement if you become disabled due to

accident, sickness or pregnancy, through Mutual of Omaha. If you experience a temporary disability, benefits begin 7 days after the

start of your disability and will continue up to a maximum of 51 weeks. California State Disability provides a benefit of 55% of your

pre‐disability earnings up to a maximum benefit of $1,129 per week. This plan supplements California State Disability an additional

30% of your pre‐disability earnings up to a maximum benefit of $1,500 per week.

Long Term Disability Insurance | Mutual of Omaha

OREMOR Automotive Group offers you Long Term Disability (LTD) to provide income replacement if you become disabled for an

extended period of time, through Mutual of Omaha. If you become totally and permanently disabled, benefits begin 360 days after

the start of your illness or injury and will continue as long as you remain disabled up to age 65 or Social Security Normal Retirement

Age. LTD works with state disability programs, Social Security, and any other group disability coverage, to provide you with a

combined monthly benefit equal to 60% of your pre‐disability earnings up to a maximum benefit of $10,000 per month.

13