Page 10 - Optima Tax EE Guide 01-20 CA

P. 10

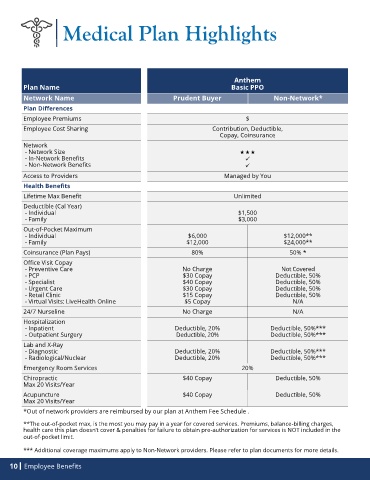

Medical Plan Highlights

Anthem

Plan Name Basic PPO

Network Name Prudent Buyer Non-Network*

Plan Differences

Employee Premiums $

Employee Cost Sharing Contribution, Deductible,

Copay, Coinsurance

Network

- Network Size

- In-Network Benefits ✓

- Non-Network Benefits ✓

Access to Providers Managed by You

Health Benefits

Lifetime Max Benefit Unlimited

Deductible (Cal Year)

- Individual $1,500

- Family $3,000

Out-of-Pocket Maximum

- Individual $6,000 $12,000**

- Family $12,000 $24,000**

Coinsurance (Plan Pays) 80% 50% *

Office Visit Copay

- Preventive Care No Charge Not Covered

- PCP $30 Copay Deductible, 50%

- Specialist $40 Copay Deductible, 50%

- Urgent Care $30 Copay Deductible, 50%

- Retail Clinic $15 Copay Deductible, 50%

- Virtual Visits: LiveHealth Online $5 Copay N/A

24/7 Nurseline No Charge N/A

Hospitalization

- Inpatient Deductible, 20% Deductible, 50%***

- Outpatient Surgery Deductible, 20% Deductible, 50%***

Lab and X-Ray

- Diagnostic Deductible, 20% Deductible, 50%***

- Radiological/Nuclear Deductible, 20% Deductible, 50%***

Emergency Room Services 20%

Chiropractic $40 Copay Deductible, 50%

Max 20 Visits/Year

Acupuncture $40 Copay Deductible, 50%

Max 20 Visits/Year

*Out of network providers are reimbursed by our plan at Anthem Fee Schedule .

**The out-of-pocket max, is the most you may pay in a year for covered services. Premiums, balance-billing charges,

health care this plan doesn’t cover & penalties for failure to obtain pre-authorization for services is NOT included in the

out-of-pocket limit.

*** Additional coverage maximums apply to Non-Network providers. Please refer to plan documents for more details.

10 Employee Benefits