Page 11 - Optima Tax EE Guide 01-20 CA

P. 11

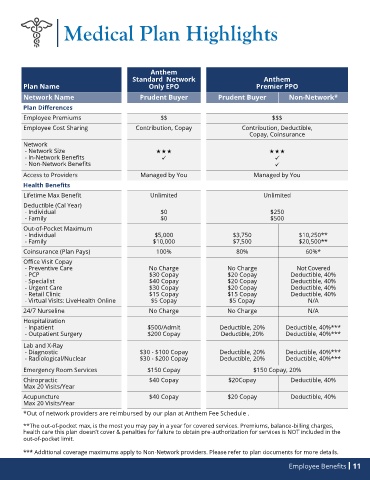

Medical Plan Highlights

Anthem

Standard Network Anthem

Plan Name Only EPO Premier PPO

Network Name Prudent Buyer Prudent Buyer Non-Network*

Plan Differences

Employee Premiums $$ $$$

Employee Cost Sharing Contribution, Copay Contribution, Deductible,

Copay, Coinsurance

Network

- Network Size

- In-Network Benefits ✓ ✓

- Non-Network Benefits ✓

Access to Providers Managed by You Managed by You

Health Benefits

Lifetime Max Benefit Unlimited Unlimited

Deductible (Cal Year)

- Individual $0 $250

- Family $0 $500

Out-of-Pocket Maximum

- Individual $5,000 $3,750 $10,250**

- Family $10,000 $7,500 $20,500**

Coinsurance (Plan Pays) 100% 80% 60%*

Office Visit Copay

- Preventive Care No Charge No Charge Not Covered

- PCP $30 Copay $20 Copay Deductible, 40%

- Specialist $40 Copay $20 Copay Deductible, 40%

- Urgent Care $30 Copay $20 Copay Deductible, 40%

- Retail Clinic $15 Copay $15 Copay Deductible, 40%

- Virtual Visits: LiveHealth Online $5 Copay $5 Copay N/A

24/7 Nurseline No Charge No Charge N/A

Hospitalization

- Inpatient $500/Admit Deductible, 20% Deductible, 40%***

- Outpatient Surgery $200 Copay Deductible, 20% Deductible, 40%***

Lab and X-Ray

- Diagnostic $30 - $100 Copay Deductible, 20% Deductible, 40%***

- Radiological/Nuclear $30 - $200 Copay Deductible, 20% Deductible, 40%***

Emergency Room Services $150 Copay $150 Copay, 20%

Chiropractic $40 Copay $20Copay Deductible, 40%

Max 20 Visits/Year

Acupuncture $40 Copay $20 Copay Deductible, 40%

Max 20 Visits/Year

*Out of network providers are reimbursed by our plan at Anthem Fee Schedule .

**The out-of-pocket max, is the most you may pay in a year for covered services. Premiums, balance-billing charges,

health care this plan doesn’t cover & penalties for failure to obtain pre-authorization for services is NOT included in the

out-of-pocket limit.

*** Additional coverage maximums apply to Non-Network providers. Please refer to plan documents for more details.

Employee Benefits 11