Page 16 - Work Life and Benefits Booklet 2018 - SDC.END.pub

P. 16

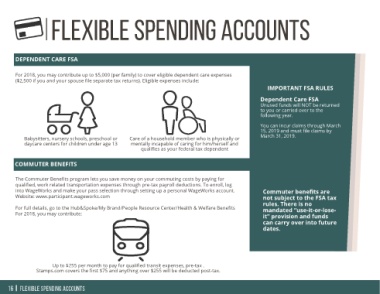

IMPORTANT FSA RULES Dependent Care FSA Unused funds will NOT be returned to you or carried over to the You can incur claims through March 15, 2019 and must file claims by Commuter benefits are not subject to the FSA tax rules. There is no mandated “use-it-or-lose- it” provision and funds can carry over into future

Flexible Spending Accounts

following year. March 31, 2019. dates.

For full details, go to the Hub&Spoke/My Brand/People Resource Center/Health & Welfare Benefits

into WageWorks and make your pass selection through setting up a personal WageWorks account.

qualified, work related transportation expenses through pre-tax payroll deductions. To enroll, log

For 2018, you may contribute up to $5,000 (per family) to cover eligible dependent care expenses

The Commuter Benefits program lets you save money on your commuting costs by paying for

($2,500 if you and your spouse file separate tax returns). Eligible expenses include:

Care of a household member who is physically or mentally incapable of caring for him/herself and qualifies as your federal tax dependent

Up to $255 per month to pay for qualified transit expenses, pre-tax . Stamps.com covers the first $75 and anything over $255 will be deducted post-tax.

DEPENDENT CARE FSA Babysitters, nursery schools, preschool or daycare centers for children under age 13 COMMUTER BENEFITS Website: www.participant.wageworks.com For 2018, you may contribute: Flexible Spending Accounts

16