Page 14 - 5.11 Benefit Guide 2019 EXECUTIVE

P. 14

SHORT TERM DISABILITY

5.11 offers you Short Term Disability (STD) income replacement if you are disabled due to accident, sickness or pregnancy,

through Lincoln Financial Group. If you experience a temporary disability, benefits begin 1 day after the start of your

accident, and 7 days after the start of your sickness or pregnancy. Short Term Disability works with state disability, Social

Security, and any other group disability coverage, to provide you with a combined monthly benefit equal to 66.67% of your

pre-disability earnings to a maximum benefit of $3,845 per week. The Short Term Disability plan will last for a duration of

12 weeks in the event of a qualifying disability. Premiums will be treated as taxable income so that benefits will be paid

out on a tax-free basis.

EMPLOYEE ASSISTANCE PROGRAM

5.11 offers a confidential Employee Assistance Programs (EAP) at no charge to employees through Lincoln Financial Group.

The EmployeeConnect program provides employees and their household members with convenient support to help meet

life’s challenges. A simple phone call connects you with a team of experienced professionals ready to assist you with a

wide range of personal, family, and work-related issues.

EmployeeConnect offers in-person sessions with a local counselor for short-term problem resolution and unlimited phone

consultations. When face-to-face sessions are warranted, you may receive up to 4 (in California, you may receive up to 3

sessions in 6 months, starting with your initial contact). You’ll also receive website access for a wide range of information,

telephone legal consultations, financial consultations/referrals, dependent care services and more.

ACCESSING THE EAP:

Go to www.lincoln4benefits.com (User Name: LFGsupport / Password: LFGsupport1) or speak with an

EAP specialist at (888) 628-4824.

401(K)

5.11 encourages all employees to participate in the company’s 401(k) plan. This plan allows you to fund for your retirement

with pre-tax dollars. You can defer a percentage of your annual salary up to IRS maximums shown in the table below. 5.11

matches 50% of the first 6% you contribute. There are multiple investment options available for the conservative to the

aggressive investor.

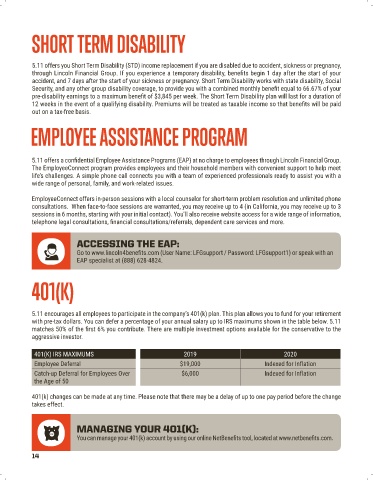

401(K) IRS MAXIMUMS 2019 2020

Employee Deferral $19,000 Indexed for Inflation

Catch-up Deferral for Employees Over $6,000 Indexed for Inflation

the Age of 50

401(k) changes can be made at any time. Please note that there may be a delay of up to one pay period before the change

takes effect.

MANAGING YOUR 401(K):

You can manage your 401(k) account by using our online NetBenefits tool, located at www.netbenefits.com.

14