Page 9 - 5.11 Benefit Guide 2019 EXECUTIVE

P. 9

SUPPLEMENTAL MEDICAL BENEFITS

AETNA | VOLUNTARY ACCIDENT INSURANCE

Aetna’s Accident Insurance can pay benefits based on the injury you receive and the treatment you need, including emergency

room care, doctor’s office visits, physical therapy and related surgery. The benefit can help offset the out-of-pocket expenses

that medical insurance does not pay, including deductibles and copays. Please make sure to review the carrier documents

for full plan details.

Premiums are paid with after-tax dollars through convenient payroll deductions. You can purchase coverage for yourself,

your spouse and your dependent child(ren). This tax-free benefit is paid directly to you.

ADVANTAGES OF VOLUNTARY ACCIDENT INSURANCE

• Any benefits you receive are tax free and paid directly to you.

• You can purchase coverage for your spouse and dependent children.

• There are no health questions to answer in order to qualify. If you apply, you automatically receive coverage under the

plan.

• This plan will work with your HSA plan to help with any deductible expenses

• The Accident plan covers a wide variety of injuries and accident-related expenses such as hospitalization, physical

therapy, emergency-room treatment, doctor office visits, fractures and dislocations, transportation, lodging and more.

• Benefits are paid for accidents that occur off the job only.

• You own the policy so you can keep this coverage if you leave the company or retire. Aetna will bill you directly.

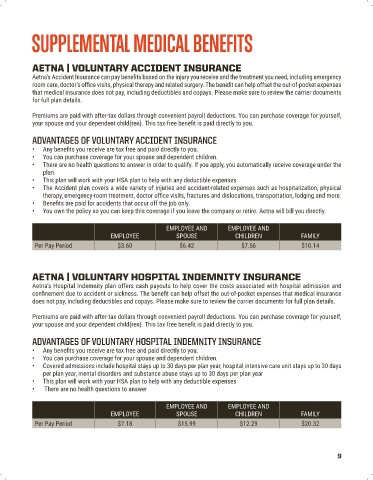

EMPLOYEE AND EMPLOYEE AND

EMPLOYEE SPOUSE CHILDREN FAMILY

Per Pay Period $3.60 $6.42 $7.56 $10.14

AETNA | VOLUNTARY HOSPITAL INDEMNITY INSURANCE

Aetna’s Hospital Indemnity plan offers cash payouts to help cover the costs associated with hospital admission and

confinement due to accident or sickness. The benefit can help offset the out-of-pocket expenses that medical insurance

does not pay, including deductibles and copays. Please make sure to review the carrier documents for full plan details.

Premiums are paid with after-tax dollars through convenient payroll deductions. You can purchase coverage for yourself,

your spouse and your dependent child(ren). This tax-free benefit is paid directly to you.

ADVANTAGES OF VOLUNTARY HOSPITAL INDEMNITY INSURANCE

• Any benefits you receive are tax free and paid directly to you.

• You can purchase coverage for your spouse and dependent children.

• Covered admissions include hospital stays up to 30 days per plan year, hospital intensive care unit stays up to 30 days

per plan year, mental disorders and substance abuse stays up to 30 days per plan year

• This plan will work with your HSA plan to help with any deductible expenses

• There are no health questions to answer

EMPLOYEE AND EMPLOYEE AND

EMPLOYEE SPOUSE CHILDREN FAMILY

Per Pay Period $7.18 $15.99 $12.29 $20.32

9