Page 6 - Veritax EE Guide 10-1-2019 - CA

P. 6

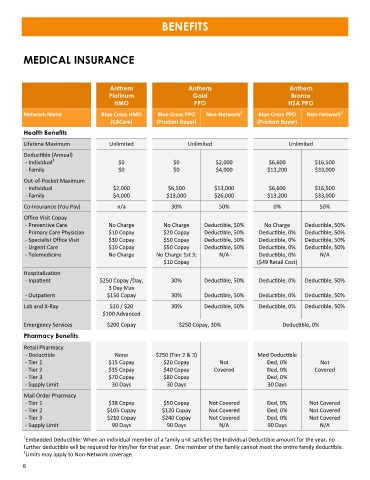

BENEFITS

MEDICAL INSURANCE

Anthem Anthem Anthem

Platinum Gold Bronze

HMO PPO HSA PPO

2

2

Network Name Blue Cross HMO Blue Cross PPO Non-Network Blue Cross PPO Non-Network

(CACare) (Prudent Buyer) (Prudent Buyer)

Health Benefits

Lifetime Maximum Unlimited Unlimited Unlimited

Deductible (Annual)

1

- Individual $0 $0 $2,000 $6,600 $16,500

- Family $0 $0 $4,000 $13,200 $33,000

Out-of-Pocket Maximum

- Individual $2,000 $6,500 $13,000 $6,600 $16,500

- Family $4,000 $13,000 $26,000 $13,200 $33,000

Co-Insurance (You Pay) n/a 30% 50% 0% 50%

Office Visit Copay

- Preventive Care No Charge No Charge Deductible, 50% No Charge Deductible, 50%

- Primary Care Physician $10 Copay $20 Copay Deductible, 50% Deductible, 0% Deductible, 50%

- Specialist Office Visit $30 Copay $50 Copay Deductible, 50% Deductible, 0% Deductible, 50%

- Urgent Care $10 Copay $50 Copay Deductible, 50% Deductible, 0% Deductible, 50%

- Telemedicine No Charge No Charge 1st 3; N/A Deductible, 0% N/A

$10 Copay ($49 Retail Cost)

Hospitalization

- Inpatient $250 Copay /Day, 30% Deductible, 50% Deductible, 0% Deductible, 50%

3 Day Max

- Outpatient $150 Copay 30% Deductible, 50% Deductible, 0% Deductible, 50%

Lab and X-Ray $10 / $20 30% Deductible, 50% Deductible, 0% Deductible, 50%

$100 Advanced

Emergency Services $200 Copay $250 Copay, 30% Deductible, 0%

Pharmacy Benefits

Retail Pharmacy

- Deductible None $250 (Tier 2 & 3) Med Deductible

- Tier 1 $15 Copay $20 Copay Not Ded, 0% Not

- Tier 2 $35 Copay $40 Copay Covered Ded, 0% Covered

- Tier 3 $70 Copay $80 Copay Ded, 0%

- Supply Limit 30 Days 30 Days 30 Days

Mail Order Pharmacy

- Tier 1 $38 Copay $50 Copay Not Covered Ded, 0% Not Covered

- Tier 2 $105 Copay $120 Copay Not Covered Ded, 0% Not Covered

- Tier 3 $210 Copay $240 Copay Not Covered Ded, 0% Not Covered

- Supply Limit 90 Days 90 Days N/A 90 Days N/A

1

Embedded Deductible: When an individual member of a family unit satisfies the Individual Deductible amount for the year, no

further deductible will be required for him/her for that year. One member of the family cannot meet the entire family deductible.

2

Limits may apply to Non-Network coverage.

6