Page 20 - Veritone EE Guide 07-19

P. 20

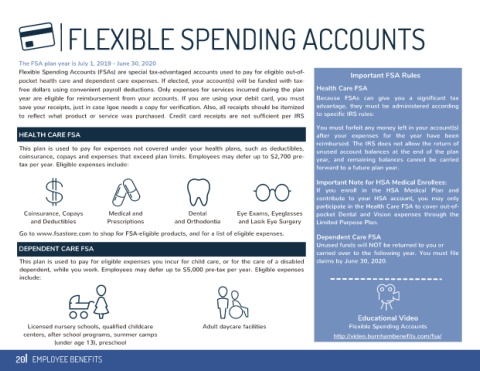

The FSA plan year is July 1, 2019 - June 30, 2020

Flexible Spending Accounts (FSAs) are special tax-advantaged accounts used to pay for eligible out-of- Important FSA Rules

pocket health care and dependent care expenses. If elected, your account(s) will be funded with tax-

free dollars using convenient payroll deductions. Only expenses for services incurred during the plan Health Care FSA

year are eligible for reimbursement from your accounts. If you are using your debit card, you must Because FSAs can give you a significant tax

save your receipts, just in case Igoe needs a copy for verification. Also, all receipts should be itemized advantage, they must be administered according

to reflect what product or service was purchased. Credit card receipts are not sufficient per IRS to specific IRS rules:

You must forfeit any money left in your account(s)

HEALTH CARE FSA after your expenses for the year have been

reimbursed. The IRS does not allow the return of

This plan is used to pay for expenses not covered under your health plans, such as deductibles, unused account balances at the end of the plan

coinsurance, copays and expenses that exceed plan limits. Employees may defer up to $2,700 pre- year, and remaining balances cannot be carried

tax per year. Eligible expenses include: forward to a future plan year.

Important Note for HSA Medical Enrollees:

If you enroll in the HSA Medical Plan and

contribute to your HSA account, you may only

participate in the Health Care FSA to cover out-of-

Coinsurance, Copays Medical and Dental Eye Exams, Eyeglasses pocket Dental and Vision expenses through the

and Deductibles Prescriptions and Orthodontia and Lasik Eye Surgery Limited Purpose Plan.

Go to www.fsastore.com to shop for FSA-eligible products, and for a list of eligible expenses. Dependent Care FSA

Unused funds will NOT be returned to you or

DEPENDENT CARE FSA

carried over to the following year. You must file

This plan is used to pay for eligible expenses you incur for child care, or for the care of a disabled claims by June 30, 2020.

dependent, while you work. Employees may defer up to $5,000 pre-tax per year. Eligible expenses

include:

Educational Video

Licensed nursery schools, qualified childcare Adult daycare facilities Flexible Spending Accounts

centers, after school programs, summer camps http://video.burnhambenefits.com/fsa/

(under age 13), preschool