Page 17 - UP_Benefits_2020_CA_Support_110519_HI

P. 17

NOTICES RETIREMENT - 401(K)

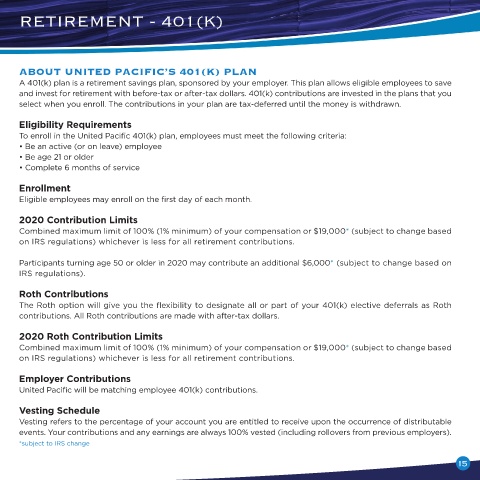

ANNUAL NOTICES ABOUT UNITED PACIFIC’S 401(K) PLAN

ERISA and various other state and federal laws require that employers provide disclosure and annual notices to A 401(k) plan is a retirement savings plan, sponsored by your employer. This plan allows eligible employees to save

their plan participants. United Pacific will distribute all federally required annual notices upon hire and during and invest for retirement with before-tax or after-tax dollars. 401(k) contributions are invested in the plans that you

each annual open enrollment period. select when you enroll. The contributions in your plan are tax-deferred until the money is withdrawn.

• Medicare Part D Notice of Creditable Coverage: Plans are required to provide each covered participant and

dependent a Certificate of Creditable Coverage to qualify for enrollment in Medicare Part D prescription drug Eligibility Requirements

coverage when qualified without a penalty. This notice also provides a written procedure for individuals to To enroll in the United Pacific 401(k) plan, employees must meet the following criteria:

request and receive Certificates of Creditable Coverage. • Be an active (or on leave) employee

• HIPAA Notice of Privacy Practices: This notice is intended to inform employees of the privacy practices • Be age 21 or older

followed by United Pacific’s group health plan. It also explains the federal privacy rights afforded to you and • Complete 6 months of service

the members of your family as plan participants covered under a group plan.

• Women’s Health and Cancer Rights Act (WHCRA): The Women’s Health and Cancer Rights Act (WHCRA) contains Enrollment

important protections for breast cancer patients who choose breast reconstruction with a mastectomy. The U.S. Eligible employees may enroll on the first day of each month.

Departments of Labor and Health and Human Services are in charge of this act of law which applies to group health

plans if the plans or coverage provide medical and surgical benefits for a mastectomy. 2020 Contribution Limits

• Newborns’ and Mothers’ Health Protection Act: The Newborns’ and Mothers’ Health Protection Act of Combined maximum limit of 100% (1% minimum) of your compensation or $19,000* (subject to change based

1996 (NMHPA) affects the amount of time a mother and her newborn child are covered for a hospital stay on IRS regulations) whichever is less for all retirement contributions.

following childbirth.

• Special Enrollment Rights: Plan participants are entitled to certain special enrollment rights outside of United Participants turning age 50 or older in 2020 may contribute an additional $6,000* (subject to change based on

IRS regulations).

Pacific’s open enrollment period. This notice provides information on special enrollment periods for loss of

prior coverage or the addition of a new dependent. Roth Contributions

• Medicaid & Children’s Health Insurance Program: Some states offer premium assistance programs for those The Roth option will give you the flexibility to designate all or part of your 401(k) elective deferrals as Roth

who are eligible for health coverage from their employers, but are unable to afford the premiums. This notice contributions. All Roth contributions are made with after-tax dollars.

provides information on how to determine if your state offers a premium assistance program.

• Summary of Benefits and Coverage (SBC): Health insurance issuers and group health plans are required to 2020 Roth Contribution Limits

provide you with an easy-to-understand summary about your health plan’s benefits and coverage. The new Combined maximum limit of 100% (1% minimum) of your compensation or $19,000* (subject to change based

regulation is designed to help you better understand and evaluate your health insurance choices. on IRS regulations) whichever is less for all retirement contributions.

LEGAL NOTICE Employer Contributions

This brochure provides an overview of your benefit plan choices. It is for informational purposes only. It is United Pacific will be matching employee 401(k) contributions.

not intended to be an agreement for continued employment. Neither is it a legal plan document. If there is a

disagreement between this guide and the plan documents, the plan documents will govern. In addition, the plans Vesting Schedule

described in this brochure are subject to change without notice. Continuation of any benefit plan or coverage is Vesting refers to the percentage of your account you are entitled to receive upon the occurrence of distributable

at the company’s discretion and in accordance with federal and state laws. If you need additional information or events. Your contributions and any earnings are always 100% vested (including rollovers from previous employers).

have any questions about the benefit program, please contact the Human Resources Department. *subject to IRS change

14 15