Page 6 - OrangeTheory Benefits Guide 07-2019_FINAL

P. 6

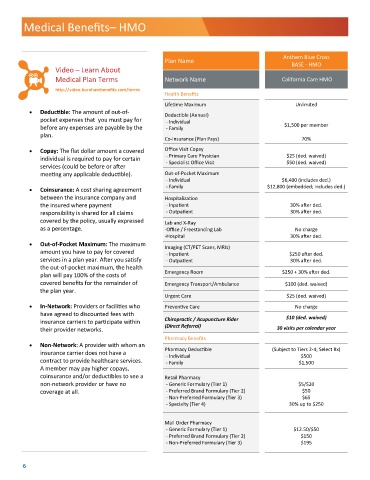

Medical Benefits– HMO

Anthem Blue Cross

Plan Name

BASE - HMO

Video – Learn About

Medical Plan Terms Network Name California Care HMO

http://video.burnhambenefits.com/terms

Health Benefits

Lifetime Maximum Unlimited

• Deductible: The amount of out-of-

Deductible (Annual)

pocket expenses that you must pay for - Individual

before any expenses are payable by the - Family $1,500 per member

plan.

Co-Insurance (Plan Pays) 70%

• Copay: The flat dollar amount a covered Office Visit Copay

- Primary Care Physician $25 (ded. waived)

individual is required to pay for certain

- Specialist Office Visit $50 (ded. waived)

services (could be before or after

meeting any applicable deductible). Out-of-Pocket Maximum

- Individual $6,400 (includes ded.)

• Coinsurance: A cost sharing agreement - Family $12,800 (embedded; includes ded.)

between the insurance company and Hospitalization

the insured where payment - Inpatient 30% after ded.

responsibility is shared for all claims - Outpatient 30% after ded.

covered by the policy, usually expressed Lab and X-Ray

as a percentage. -Office / Freestanding Lab No charge

-Hospital 30% after ded.

• Out-of-Pocket Maximum: The maximum

Imaging (CT/PET Scans, MRIs)

amount you have to pay for covered - Inpatient $250 after ded.

services in a plan year. After you satisfy - Outpatient 30% after ded.

the out-of-pocket maximum, the health

plan will pay 100% of the costs of Emergency Room $250 + 30% after ded.

covered benefits for the remainder of Emergency Transport/Ambulance $100 (ded. waived)

the plan year.

Urgent Care $25 (ded. waived)

• In-Network: Providers or facilities who Preventive Care No charge

have agreed to discounted fees with $10 (ded. waived)

insurance carriers to participate within Chiropractic / Acupuncture Rider

(Direct Referral)

their provider networks. 30 visits per calendar year

Pharmacy Benefits

• Non-Network: A provider with whom an

Pharmacy Deductible (Subject to Tiers 2-4; Select Rx)

insurance carrier does not have a - Individual $500

contract to provide healthcare services. - Family $1,500

A member may pay higher copays,

coinsurance and/or deductibles to see a Retail Pharmacy

non-network provider or have no - Generic Formulary (Tier 1) $5/$20

coverage at all. - Preferred Brand Formulary (Tier 2) $50

- Non-Preferred Formulary (Tier 3) $65

- Specialty (Tier 4) 30% up to $250

Mail Order Pharmacy

- Generic Formulary (Tier 1) $12.50/$50

- Preferred Brand Formulary (Tier 2) $150

- Non-Preferred Formulary (Tier 3) $195

6