Page 15 - Veritone EE Guide OOS_ 2019

P. 15

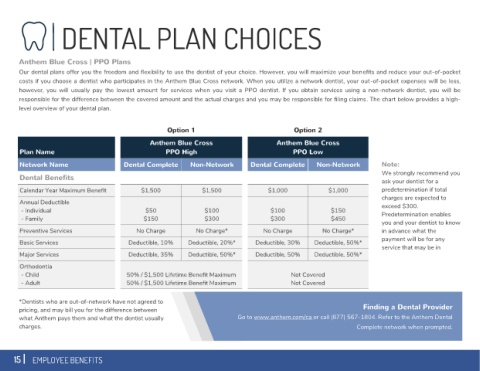

Anthem Blue Cross | PPO Plans

Our dental plans offer you the freedom and flexibility to use the dentist of your choice. However, you will maximize your benefits and reduce your out-of-pocket

costs if you choose a dentist who participates in the Anthem Blue Cross network. When you utilize a network dentist, your out-of-pocket expenses will be less,

however, you will usually pay the lowest amount for services when you visit a PPO dentist. If you obtain services using a non-network dentist, you will be

responsible for the difference between the covered amount and the actual charges and you may be responsible for filing claims. The chart below provides a high-

level overview of your dental plan.

Option 1 Option 2

Anthem Blue Cross Anthem Blue Cross

Plan Name PPO High PPO Low

Network Name Dental Complete Non-Network Dental Complete Non-Network Note:

We strongly recommend you

Dental Benefits ask your dentist for a

Calendar Year Maximum Benefit $1,500 $1,500 $1,000 $1,000 predetermination if total

charges are expected to

Annual Deductible exceed $300.

- Individual $50 $100 $100 $150 Predetermination enables

- Family $150 $300 $300 $450

you and your dentist to know

Preventive Services No Charge No Charge* No Charge No Charge* in advance what the

Basic Services Deductible, 10% Deductible, 20%* Deductible, 30% Deductible, 50%* payment will be for any

service that may be in

Major Services Deductible, 35% Deductible, 50%* Deductible, 50% Deductible, 50%*

Orthodontia

- Child 50% / $1,500 Lifetime Benefit Maximum Not Covered

- Adult 50% / $1,500 Lifetime Benefit Maximum Not Covered

*Dentists who are out-of-network have not agreed to

pricing, and may bill you for the difference between Finding a Dental Provider

what Anthem pays them and what the dentist usually Go to www.anthem.com/ca or call (877) 567-1804. Refer to the Anthem Dental

charges. Complete network when prompted.