Page 7 - 5.11 Benefit Guide 2019 EXECUTIVE

P. 7

MEDICAL

ABOUT THE HSA OPTION

A Health Savings Account (HSA) is a tax-advantaged account that you own. Both you and 5.11 can make tax-free contributions.

5.11 contributes $500 for Employee Only, $750 for Employee + Spouse or Child(ren) and $1,200 for Employee + Family

coverage over the next 12 months. You can contribute additional funds into your HSA up to the 2019 IRS maximum ($3,500

for Employee and $7,000 for Family). The contributions earn interest and can be used to cover a wide range of healthcare

expenses. Whatever amount that remains in your account at the end of the year “rolls-over.” Most importantly, your HSA is

portable and offers you freedom for the future.

The HSA Medical option includes a high deductible health plan. After the deductible has been satisfied, you will pay the

copays and coinsurance shown in the benefit summary up to the out-of-pocket-maximum. You have the option of signing

up for an HSA debit card that you can use to pay providers. To get the most effective use of the debit card, we recommend

that you only use your debit card to pay providers after your claim has been submitted to the insurance company and you

receive your Explanation of Benefits (EOB). This way you can take full advantage of your Aetna Managed Choice discount

(if applicable). Your Aetna Managed Choice discount is applied real-time at the pharmacy making this a great place to use

your debit card.

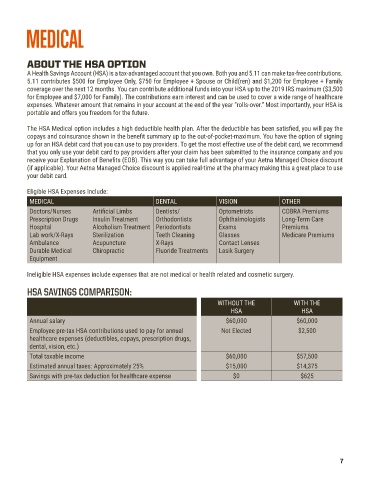

Eligible HSA Expenses Include:

MEDICAL DENTAL VISION OTHER

Doctors/Nurses Artificial Limbs Dentists/ Optometrists COBRA Premiums

Prescription Drugs Insulin Treatment Orthodontists Ophthalmologists Long-Term Care

Hospital Alcoholism Treatment Periodontists Exams Premiums

Lab work/X-Rays Sterilization Teeth Cleaning Glasses Medicare Premiums

Ambulance Acupuncture X-Rays Contact Lenses

Durable Medical Chiropractic Fluoride Treatments Lasik Surgery

Equipment

Ineligible HSA expenses include expenses that are not medical or health related and cosmetic surgery.

HSA SAVINGS COMPARISON:

WITHOUT THE WITH THE

HSA HSA

Annual salary $60,000 $60,000

Employee pre-tax HSA contributions used to pay for annual Not Elected $2,500

healthcare expenses (deductibles, copays, prescription drugs,

dental, vision, etc.)

Total taxable income $60,000 $57,500

Estimated annual taxes: Approximately 25% $15,000 $14,375

Savings with pre-tax deduction for healthcare expense $0 $625

7