Page 11 - Surfline Benefits Guide 2017

P. 11

Medical

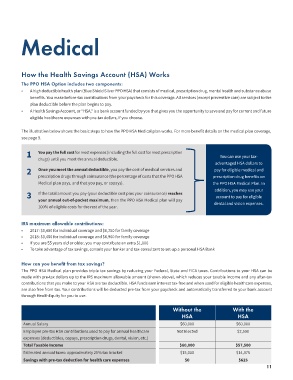

How the Health Savings Account (HSA) Works

The PPO HSA Option includes two components:

• A high deductible health plan (Blue Shield Silver PPO HSA) that consists of medical, prescription drug, mental health and substance abuse

benefits. You make before-tax contributions from your paycheck for this coverage. All services (except preventive care) are subject to the

plan deductible before the plan begins to pay.

• A Health Savings Account, or “HSA,” is a bank account funded by you that gives you the opportunity to save and pay for current and future

eligible healthcare expenses with pre-tax dollars, if you choose.

The illustration below shows the basic steps to how the PPO HSA Medical plan works. For more benefit details on the medical plan coverage,

see page 9.

1 You pay the full cost for most expenses (including the full cost for most prescription You can use your tax-

drugs) until you meet the annual deductible.

advantaged HSA dollars to

2 Once you meet the annual deductible, you pay the cost of medical services and pay for eligible medical and

prescription drugs through coinsurance (the percentage of costs that the PPO HSA prescription drug benefits on

Medical plan pays, and that you pay, or copays). the PPO HSA Medical Plan. In

addition, you may use your

3 If the total amount you pay (your deductible cost plus your coinsurance) reaches account to pay for eligible

your annual out-of-pocket maximum, then the PPO HSA Medical plan will pay dental and vision expenses.

100% of eligible costs for the rest of the year.

IRS maximum allowable contributions:

• 2017: $3,400 for individual coverage and $6,750 for family coverage

• 2018: $3,450 for individual coverage and $6,900 for family coverage

• If you are 55 years old or older, you may contribute an extra $1,000

• To take advantage of tax savings, consult your banker and tax-consultant to set-up a personal HSA Bank

How can you benefit from tax savings?

The PPO HSA Medical plan provides triple tax savings by reducing your Federal, State and FICA taxes. Contributions to your HSA can be

made with pre-tax dollars up to the IRS maximum allowable amount (shown above), which reduces your taxable income and any after-tax

contributions that you make to your HSA are tax deductible. HSA funds earn interest tax-free and when used for eligible healthcare expenses,

are also free from tax. Your contributions will be deducted pre-tax from your paycheck and automatically transferred to your bank account

through HealthEquity for you to use.

Without the With the

HSA HSA

Annual Salary $60,000 $60,000

Employee pre-tax HSA contributions used to pay for annual healthcare Not Elected $2,500

expenses (deductibles, copays, prescription drugs, dental, vision, etc.)

Total Taxable Income $60,000 $57,500

Estimated annual taxes: approximately 25% tax bracket $15,000 $14,375

Savings with pre-tax deduction for health care expenses $0 $625

11 11