Page 10 - Benefits Guide_Stage 1

P. 10

Basic Life and AD&D Insurance

Life insurance protects your family or other beneficiaries in the event of your death while you are still actively employed with the

company. Stage 1 Financial pays for coverage, offered through United Healthcare, in the amount of $25,000. If your death is due to

a covered accident or injury, your beneficiary will receive an additional amount through Accidental Death and Dismemberment

(AD&D) coverage.

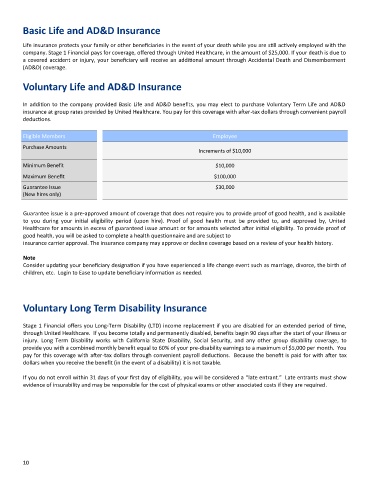

Voluntary Life and AD&D Insurance

In addition to the company provided Basic Life and AD&D benefits, you may elect to purchase Voluntary Term Life and AD&D

insurance at group rates provided by United Healthcare. You pay for this coverage with after-tax dollars through convenient payroll

deductions.

Eligible Members Employee

Purchase Amounts

Increments of $10,000

Minimum Benefit $10,000

Maximum Benefit $100,000

Guarantee Issue $30,000

(New hires only)

Guarantee issue is a pre-approved amount of coverage that does not require you to provide proof of good health, and is available

to you during your initial eligibility period (upon hire). Proof of good health must be provided to, and approved by, United

Healthcare for amounts in excess of guaranteed issue amount or for amounts selected after initial eligibility. To provide proof of

good health, you will be asked to complete a health questionnaire and are subject to

insurance carrier approval. The insurance company may approve or decline coverage based on a review of your health history.

Note

Consider updating your beneficiary designation if you have experienced a life change event such as marriage, divorce, the birth of

children, etc. Login to Ease to update beneficiary information as needed.

Voluntary Long Term Disability Insurance

Stage 1 Financial offers you Long-Term Disability (LTD) income replacement if you are disabled for an extended period of time,

through United Healthcare. If you become totally and permanently disabled, benefits begin 90 days after the start of your illness or

injury. Long Term Disability works with California State Disability, Social Security, and any other group disability coverage, to

provide you with a combined monthly benefit equal to 60% of your pre-disability earnings to a maximum of $5,000 per month. You

pay for this coverage with after-tax dollars through convenient payroll deductions. Because the benefit is paid for with after tax

dollars when you receive the benefit (in the event of a disability) it is not taxable.

If you do not enroll within 31 days of your first day of eligibility, you will be considered a “late entrant.” Late entrants must show

evidence of insurability and may be responsible for the cost of physical exams or other associated costs if they are required.

10