Page 11 - open_enrollment_benefits_book_CA_2018_v1

P. 11

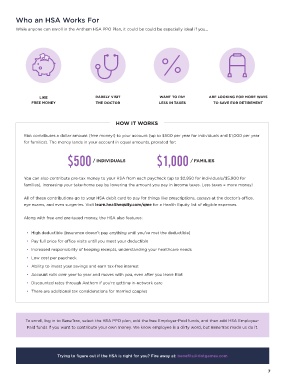

Who an HSA Works For

While anyone can enroll in the Anthem HSA PPO Plan, it could be could be especially ideal if you…

LIKE RARELY VISIT WANT TO PAY ARE LOOKING FOR MORE WAYS

FREE MONEY THE DOCTOR LESS IN TAXES TO SAVE FOR RETIREMENT

HOW IT WORKS

Riot contributes a dollar amount (free money!) to your account (up to $500 per year for individuals and $1,000 per year

for families). The money lands in your account in equal amounts, prorated for:

$500 / INDIVIDUALS $1,000 / FAMILIES

You can also contribute pre-tax money to your HSA from each paycheck (up to $2,950 for individuals/$5,900 for

families), increasing your take-home pay by lowering the amount you pay in income taxes. Less taxes = more money!

All of these contributions go to your HSA debit card to pay for things like prescriptions, copays at the doctor’s office,

eye exams, and even surgeries. Visit learn.healthequity.com/qme for a Health Equity list of eligible expenses.

Along with free and pre-taxed money, the HSA also features:

• High deductible (insurance doesn’t pay anything until you’ve met the deductible)

• Pay full price for office visits until you meet your deductible

• Increased responsibility of keeping receipts, understanding your healthcare needs

• Low cost per paycheck

• Ability to invest your savings and earn tax-free interest

• Account rolls over year to year and moves with you, even after you leave Riot

• Discounted rates through Anthem if you’re getting in-network care

• There are additional tax considerations for married couples

To enroll, log in to BeneTrac, select the HSA PPO plan, add the free Employer-Paid funds, and then add HSA Employee-

Paid funds if you want to contribute your own money. We know employee is a dirty word, but BeneTrac made us do it.

Trying to figure out if the HSA is right for you? Fire away at: benefits@riotgames.com

7