Page 13 - TCR Benefit Guide 2017 - Non-CA - sent 9.12.17

P. 13

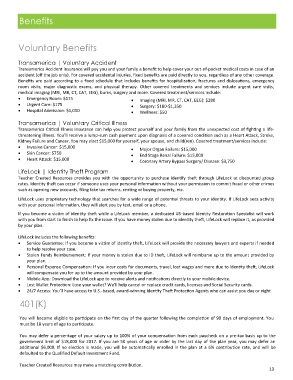

Benefits

Voluntary Benefits

Transamerica | Voluntary Accident

Transamerica Accident insurance will pay you and your family a benefit to help cover your out-of-pocket medical costs in case of an

accident (off the job only). For covered accidental injuries, fixed benefits are paid directly to you, regardless of any other coverage.

Benefits are paid according to a fixed schedule that includes benefits for hospitalization, fractures and dislocations, emergency

room visits, major diagnostic exams, and physical therapy. Other covered treatments and services include urgent care visits,

medical imaging (MRI, MR, CT, CAT, EEG), burns, surgery and more. Covered treatment/services include:

• Emergency Room: $175 • Imaging (MRI, MR, CT, CAT, EEG): $280

• Urgent Care: $175 • Surgery: $180-$1,350

• Hospital Admission: $1,050 • Wellness: $50

Transamerica | Voluntary Critical Illness

Transamerica Critical Illness insurance can help you protect yourself and your family from the unexpected cost of fighting a life-

threatening illness. You’ll receive a lump-sum cash payment upon diagnosis of a covered condition such as a Heart Attack, Stroke,

Kidney Failure and Cancer. You may elect $15,000 for yourself, your spouse, and child(ren). Covered treatment/services include:

• Invasive Cancer: $15,000 • Major Organ Failure: $15,000

• Skin Cancer: $750 • End Stage Renal Failure: $15,000

• Heart Attack: $15,000 • Coronary Artery Bypass Surgery/ Disease: $3,750

LifeLock | Identity Theft Program

Teacher Created Resources provides you with the opportunity to purchase identify theft through LifeLock at discounted group

rates. Identity theft can occur if someone uses your personal information without your permission to commit fraud or other crimes

such as opening new accounts, filing fake tax returns, renting or buying property, etc.

LifeLock uses proprietary technology that searches for a wide range of potential threats to your identity. If LifeLock sees activity

with your personal information, they will alert you by text, email or a phone.

If you become a victim of identity theft while a LifeLock member, a dedicated US-based Identity Restoration Specialist will work

with you from start to finish to help fix the issue. If you have money stolen due to identity theft, LifeLock will replace it, as provided

by your plan.

LifeLock includes the following benefits:

• Service Guarantee: If you become a victim of identity theft, LifeLock will provide the necessary lawyers and experts if needed

to help resolve your case.

• Stolen Funds Reimbursement: If your money is stolen due to ID theft, LifeLock will reimburse up to the amount provided by

your plan.

• Personal Expense Compensation: If you incur costs for documents, travel, lost wages and more due to identity theft, LifeLock

will compensate you for up to the amount provided by your plan.

• Mobile App: Download the LifeLock app to receive alerts and notifications directly to your mobile device.

• Lost Wallet Protection: Lose your wallet? We’ll help cancel or replace credit cards, licenses and Social Security cards.

• 24/7 Access: You’ll have access to U.S.-based, award-winning Identity Theft Protection Agents who can assist you day or night

401(K)

You will become eligible to participate on the first day of the quarter following the completion of 90 days of employment. You

must be 18 years of age to participate.

You may defer a percentage of your salary up to 100% of your compensation from each paycheck on a pre-tax basis up to the

government limit of $18,000 for 2017. If you are 50 years of age or older by the last day of the plan year, you may defer an

additional $6,000. If no election is made, you will be automatically enrolled in the plan at a 6% contribution rate, and will be

defaulted to the Qualified Default Investment Fund.

Teacher Created Resources may make a matching contribution.

13