Page 4 - UP_Benefits_2018_NonCA_Support_110917_FLIP

P. 4

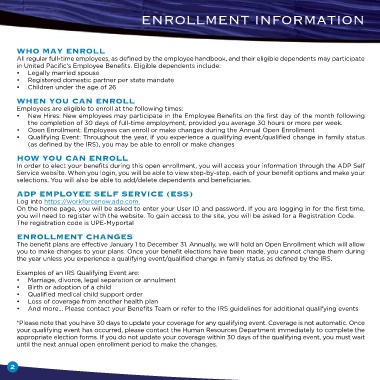

enrollment InformatIon

Who May Enroll

All regular full-time employees, as defined by the employee handbook, and their eligible dependents may participate

in United Pacific’s Employee Benefits. Eligible dependents include:

• Legally married spouse

• Registered domestic partner per state mandate

• Children under the age of 26

WhEn you Can Enroll

Employees are eligible to enroll at the following times:

• New Hires: New employees may participate in the Employee Benefits on the first day of the month following

the completion of 30 days of full-time employment, provided you average 30 hours or more per week.

• Open Enrollment: Employees can enroll or make changes during the Annual Open Enrollment

• Qualifying Event: Throughout the year, if you experience a qualifying event/qualified change in family status

(as defined by the IRS), you may be able to enroll or make changes

hoW you Can Enroll

In order to elect your benefits during this open enrollment, you will access your information through the ADP Self

Service website. When you login, you will be able to view step-by-step, each of your benefit options and make your

selections. You will also be able to add/delete dependents and beneficiaries.

aDP EMPloyEE SElf SErviCE (ESS)

Log into https://workforcenow.adp.com.

On the home page, you will be asked to enter your User ID and password. If you are logging in for the first time,

you will need to register with the website. To gain access to the site, you will be asked for a Registration Code.

The registration code is UPE-Myportal

EnrollMEnt ChangES

The benefit plans are effective January 1 to December 31. Annually, we will hold an Open Enrollment which will allow

you to make changes to your plans. Once your benefit elections have been made, you cannot change them during

the year unless you experience a qualifying event/qualified change in family status as defined by the IRS.

Examples of an IRS Qualifying Event are:

• Marriage, divorce, legal separation or annulment

• Birth or adoption of a child

• Qualified medical child support order

• Loss of coverage from another health plan

• And more… Please contact your Benefits Team or refer to the IRS guidelines for additional qualifying events

*Please note that you have 30 days to update your coverage for any qualifying event. Coverage is not automatic. Once

your qualifying event has occurred, please contact the Human Resources Department immediately to complete the

appropriate election forms. If you do not update your coverage within 30 days of the qualifying event, you must wait

until the next annual open enrollment period to make the changes.

2