Page 6 - Sample Calendar Layout EE Guide

P. 6

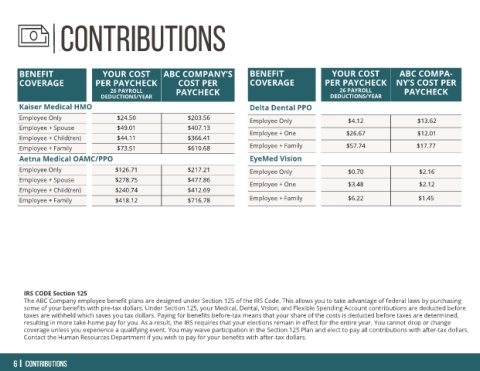

BENEFIT YOUR COST ABC COMPANY’S BENEFIT YOUR COST ABC COMPA-

COVERAGE PER PAYCHECK COST PER COVERAGE PER PAYCHECK NY’S COST PER

26 PAYROLL PAYCHECK 26 PAYROLL PAYCHECK

DEDUCTIONS/YEAR DEDUCTIONS/YEAR

Kaiser Medical HMO Delta Dental PPO

Employee Only $24.50 $203.56 Employee Only $4.12 $13.62

Employee + Spouse $49.01 $407.13

Employee + Child(ren) $44.11 $366.41 Employee + One $26.67 $12.01

Employee + Family $73.51 $610.68 Employee + Family $57.74 $17.77

Aetna Medical OAMC/PPO EyeMed Vision

Employee Only $126.71 $217.21 Employee Only $0.70 $2.16

Employee + Spouse $278.75 $477.86 Employee + One $3.48 $2.12

Employee + Child(ren) $240.74 $412.69

Employee + Family $418.12 $716.78 Employee + Family $6.22 $1.45

IRS CODE Section 125

The ABC Company employee benefit plans are designed under Section 125 of the IRS Code. This allows you to take advantage of federal laws by purchasing

some of your benefits with pre-tax dollars. Under Section 125, your Medical, Dental, Vision, and Flexible Spending Account contributions are deducted before

taxes are withheld which saves you tax dollars. Paying for benefits before-tax means that your share of the costs is deducted before taxes are determined,

resulting in more take-home pay for you. As a result, the IRS requires that your elections remain in effect for the entire year. You cannot drop or change

coverage unless you experience a qualifying event. You may waive participation in the Section 125 Plan and elect to pay all contributions with after-tax dollars.

Contact the Human Resources Department if you wish to pay for your benefits with after-tax dollars.