Page 13 - OrangeTheory Benefits Guide 07-2019_FINAL - NonCA

P. 13

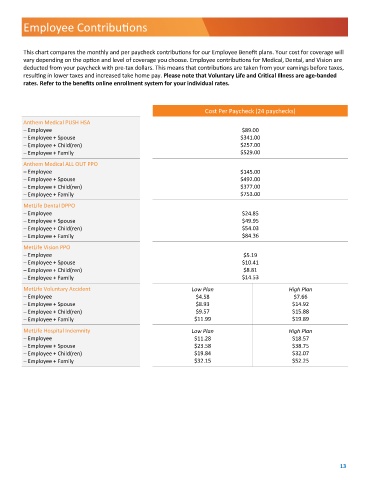

Employee Contributions

This chart compares the monthly and per paycheck contributions for our Employee Benefit plans. Your cost for coverage will

vary depending on the option and level of coverage you choose. Employee contributions for Medical, Dental, and Vision are

deducted from your paycheck with pre-tax dollars. This means that contributions are taken from your earnings before taxes,

resulting in lower taxes and increased take home pay. Please note that Voluntary Life and Critical Illness are age-banded

rates. Refer to the benefits online enrollment system for your individual rates.

Cost Per Paycheck (24 paychecks)

Anthem Medical PUSH HSA

− Employee $89.00

− Employee + Spouse $341.00

− Employee + Child(ren) $257.00

− Employee + Family $529.00

Anthem Medical ALL OUT PPO

− Employee $145.00

− Employee + Spouse $492.00

− Employee + Child(ren) $377.00

− Employee + Family $753.00

MetLife Dental DPPO

− Employee $24.85

− Employee + Spouse $49.95

− Employee + Child(ren) $54.03

− Employee + Family $84.36

MetLife Vision PPO

− Employee $5.19

− Employee + Spouse $10.41

− Employee + Child(ren) $8.81

− Employee + Family $14.53

MetLife Voluntary Accident Low Plan High Plan

− Employee $4.58 $7.66

− Employee + Spouse $8.93 $14.92

− Employee + Child(ren) $9.57 $15.88

− Employee + Family $11.99 $19.89

MetLife Hospital Indemnity Low Plan High Plan

− Employee $11.28 $18.57

− Employee + Spouse $23.58 $38.75

− Employee + Child(ren) $19.84 $32.07

− Employee + Family $32.15 $52.25

13