Page 7 - California Steel EE Guide 01-19

P. 7

BENEFITS

Medical Insurance and Prescription Drugs

How the Health Savings Account (HSA) Works

The opportunity to establish and contribute to a Health Savings Account is available when you

elect the HSA PPO medical plan option. It’s like a personal, tax-free savings account for health

care expenses that earns interest. Any unused money rolls over from year to year.

In 2019, CSI will make the following monthly contributions

into your HSA account:

• Employee: $70 Examples of

• Family: $140

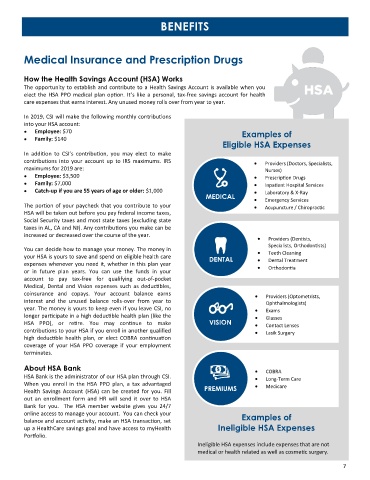

Eligible HSA Expenses

In addition to CSI’s contribution, you may elect to make

contributions into your account up to IRS maximums. IRS • Providers (Doctors, Specialists,

maximums for 2019 are: Nurses)

• Employee: $3,500 • Prescription Drugs

• Family: $7,000 • Inpatient Hospital Services

• Catch-up if you are 55 years of age or older: $1,000 • Laboratory & X-Ray

MEDICAL • Emergency Services

The portion of your paycheck that you contribute to your • Acupuncture / Chiropractic

HSA will be taken out before you pay federal income taxes,

Social Security taxes and most state taxes (excluding state

taxes in AL, CA and NJ). Any contributions you make can be

increased or decreased over the course of the year. •

Providers (Dentists,

Specialists, Orthodontists)

You can decide how to manage your money. The money in • Teeth Cleaning

your HSA is yours to save and spend on eligible health care DENTAL • Dental Treatment

expenses whenever you need it, whether in this plan year •

or in future plan years. You can use the funds in your Orthodontia

account to pay tax-free for qualifying out-of-pocket

Medical, Dental and Vision expenses such as deductibles,

coinsurance and copays. Your account balance earns • Providers (Optometrists,

interest and the unused balance rolls-over from year to Ophthalmologists)

year. The money is yours to keep even if you leave CSI, no • Exams

longer participate in a high deductible health plan (like the • Glasses

HSA PPO), or retire. You may continue to make VISION • Contact Lenses

contributions to your HSA if you enroll in another qualified • Lasik Surgery

high deductible health plan, or elect COBRA continuation

coverage of your HSA PPO coverage if your employment

terminates.

About HSA Bank • COBRA

HSA Bank is the administrator of our HSA plan through CSI. • Long-Term Care

When you enroll in the HSA PPO plan, a tax advantaged • Medicare

Health Savings Account (HSA) can be created for you. Fill PREMIUMS

out an enrollment form and HR will send it over to HSA

Bank for you. The HSA member website gives you 24/7

online access to manage your account. You can check your Examples of

balance and account activity, make an HSA transaction, set

up a HealthCare savings goal and have access to myHealth Ineligible HSA Expenses

Portfolio.

Ineligible HSA expenses include expenses that are not

medical or health related as well as cosmetic surgery.

7