Page 12 - Work Life and Benefits Booklet 2020 SDC EDC

P. 12

SAVINGS

How the Health Savings Account (HSA) Works

If you enroll in the HSA PPO plan, you can take advantage of the Health Savings bank account feature. A Health Savings Account (HSA) is a tax-advantaged account

that you own. You may elect to make pre-tax contributions into your account up to IRS maximums. IRS maximums for 2020 are $3,550 for employee coverage and

$7,100 for family coverage. If you are 55 years of age or older in 2020, the IRS also permits you an additional catch-up contribution of $1,000. The portion of your

paycheck that you contribute to your HSA will be taken out before you pay federal income taxes, Social Security taxes and most state taxes (excluding state taxes in

AL, CA and NJ). Any contributions you make can be increased or decreased over the course of the year.

You can decide how to manage your money. The money in your HSA is yours to save and spend on eligible health care expenses whenever you need it, whether in

this plan year or in future plan years. You can use the funds in your account to pay tax-free for qualifying out-of-pocket Medical, Dental and Vision expenses such as

deductibles, coinsurance and copays. Your account balance earns interest and the unused balance rolls-over from year to year. The money is yours to keep even if

you leave Stamps, no longer participate in a high deductible health plan, or retire.

The HSA administration is managed by Igoe/Avidia Bank. Once you reach $1,000 of funds, you may invest your dollars with Avidia Bank’s portfolio of funds. More

information about Avidia fund options are available here: https://hsainvestments.com/fundperformance/?p=508.

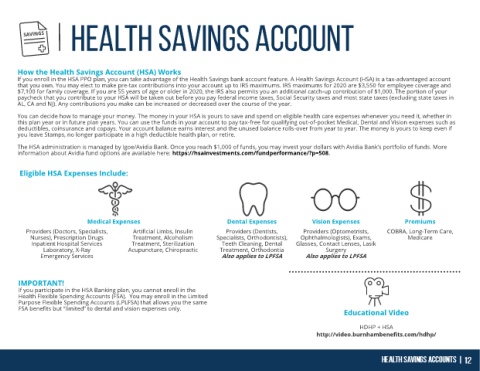

Eligible HSA Expenses Include:

Medical Expenses Dental Expenses Vision Expenses Premiums

Providers (Doctors, Specialists, Artificial Limbs, Insulin Providers (Dentists, Providers (Optometrists, COBRA, Long-Term Care,

Nurses), Prescription Drugs Treatment, Alcoholism Specialists, Orthodontists), Ophthalmologists), Exams, Medicare

Inpatient Hospital Services Treatment, Sterilization Teeth Cleaning, Dental Glasses, Contact Lenses, Lasik

Laboratory, X-Ray Acupuncture, Chiropractic Treatment, Orthodontia Surgery

Emergency Services Also applies to LPFSA Also applies to LPFSA

IMPORTANT!

If you participate in the HSA Banking plan, you cannot enroll in the

Health Flexible Spending Accounts (FSA). You may enroll in the Limited

Purpose Flexible Spending Accounts (LPLFSA) that allows you the same

FSA benefits but “limited” to dental and vision expenses only.

Educational Video

HDHP + HSA

http://video.burnhambenefits.com/hdhp/