Page 17 - open_enrollment_benefits_book_NA_2018_v4

P. 17

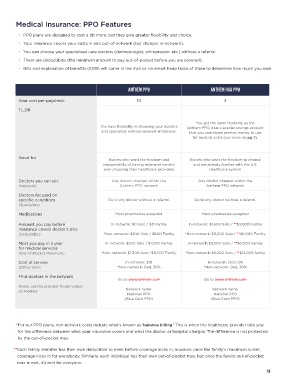

Medical Insurance: PPO Features

• PPO plans are designed to cost a bit more, but they give greater flexibility and choice.

• Your insurance covers your costs in and out-of-network (but cheaper in-network).

• You can choose your specialized care doctors (dermatologist, chiropractor, etc.) without a referral.

• There are deductibles (the minimum amount to pay out-of-pocket before you are covered).

• Bills and explanation of benefits (EOB) will come in the mail or via email. Keep track of these to determine how much you owe.

ANTHEM PPO ANTHEM HSA PPO

Your cost per paycheck $$ $

TL;DR

You get the same flexibility as the

You have flexibility in choosing your doctors Anthem PPO, plus a special savings account

and specialists without network limitations. that you contribute pre-tax money to use

for medical costs (see more on pg 7).

Good for Rioters who want the freedom and Rioters who want the freedom to choose

responsibility of having extensive control and are already familiar with the U.S.

over choosing their healthcare providers healthcare system

Doctors you can see Any doctor, cheaper within the Any doctor, cheaper within the

(Network) Anthem PPO network Anthem PPO network

Doctors focused on

specific conditions Go to any doctor without a referral. Go to any doctor without a referral.

(Specialists)

Medications Most pharmacies accepted Most pharmacies accepted

Amount you pay before In-network: $0 Solo / $0 Family In-network: $1,500 Solo / **$3,000 Family

insurance covers doctor’s bills

(Deductible) *Non-network: $200 Solo / $600 Family *Non-network: $3,000 Solo / **$6,000 Family

Most you pay in a year In-network: $500 Solo / $1,000 Family In-network: $3,000 Solo / **$6,000 Family

for medical services

(Out-of-Pocket Maximum) *Non-network: $1,500 Solo / $3,000 Family *Non-network: $6,000 Solo / **$12,000 family

Cost at service In-network: $10 In-network: Ded, 0%

(Office Visit) *Non-network: Ded, 30% *Non-network: Ded, 30%

Find doctors in the network

Go to www.anthem.com Go to www.anthem.com

Check out the provider finder videos

on RiotNet Network name: Network name:

National PPO National PPO

(Blue Card PPO) (Blue Card PPO)

* For our PPO plans, non-network costs include what’s known as ‘balance billing.’ This is when the healthcare provider bills you

for the difference between what your insurance covers and what the doctor or hospital charges. The difference is not protected

by the out-of-pocket max.

** Each family member has their own deductible to meet before coverage kicks in; however, once the family’s maximum is met,

coverage kicks in for everybody. Similarly, each individual has their own out-of-pocket max, but once the family out-of-pocket

max is met, it’s met for everyone.

13