Page 8 - Wellbiz Brands Benefit Guide 2020

P. 8

BENEFITS

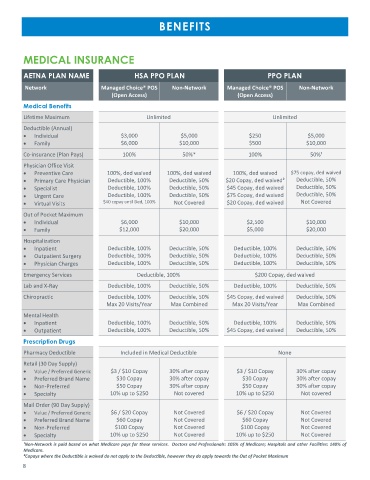

MEDICAL INSURANCE

AETNA PLAN NAME HSA PPO PLAN PPO PLAN

Network Managed Choice® POS Non-Network Managed Choice® POS Non-Network

(Open Access) (Open Access)

Medical Benefits

Lifetime Maximum Unlimited Unlimited

Deductible (Annual)

• Individual $3,000 $5,000 $250 $5,000

• Family $6,000 $10,000 $500 $10,000

Co-insurance (Plan Pays) 100% 50%* 100% 50%¹

Physician Office Visit

• Preventive Care 100%, ded waived 100%, ded waived 100%, ded waived $75 copay, ded waived

• Primary Care Physician Deductible, 100% Deductible, 50% $20 Copay, ded waived² Deductible, 50%

• Specialist Deductible, 100% Deductible, 50% $45 Copay, ded waived Deductible, 50%

• Urgent Care Deductible, 100% Deductible, 50% $75 Copay, ded waived Deductible, 50%

• Virtual Visits $40 copay until Ded, 100% Not Covered $20 Copay, ded waived Not Covered

Out of Pocket Maximum

• Individual $6,000 $10,000 $2,500 $10,000

• Family $12,000 $20,000 $5,000 $20,000

Hospitalization

• Inpatient Deductible, 100% Deductible, 50% Deductible, 100% Deductible, 50%

• Outpatient Surgery Deductible, 100% Deductible, 50% Deductible, 100% Deductible, 50%

• Physician Charges Deductible, 100% Deductible, 50% Deductible, 100% Deductible, 50%

Emergency Services Deductible, 100% $200 Copay, ded waived

Lab and X-Ray Deductible, 100% Deductible, 50% Deductible, 100% Deductible, 50%

Chiropractic Deductible, 100% Deductible, 50% $45 Copay, ded waived Deductible, 50%

Max 20 Visits/Year Max Combined Max 20 Visits/Year Max Combined

Mental Health

• Inpatient Deductible, 100% Deductible, 50% Deductible, 100% Deductible, 50%

• Outpatient Deductible, 100% Deductible, 50% $45 Copay, ded waived Deductible, 50%

Prescription Drugs

Pharmacy Deductible Included in Medical Deductible None

Retail (30 Day Supply)

• Value / Preferred Generic $3 / $10 Copay 30% after copay $3 / $10 Copay 30% after copay

• Preferred Brand Name $30 Copay 30% after copay $30 Copay 30% after copay

• Non-Preferred $50 Copay 30% after copay $50 Copay 30% after copay

• Specialty 10% up to $250 Not covered 10% up to $250 Not covered

Mail Order (90 Day Supply)

• Value / Preferred Generic $6 / $20 Copay Not Covered $6 / $20 Copay Not Covered

• Preferred Brand Name $60 Copay Not Covered $60 Copay Not Covered

• Non-Preferred $100 Copay Not Covered $100 Copay Not Covered

• Specialty 10% up to $250 Not Covered 10% up to $250 Not Covered

¹Non-Network is paid based on what Medicare pays for these services. Doctors and Professionals: 105% of Medicare; Hospitals and other Facilities: 140% of

Medicare.

²Copays where the Deductible is waived do not apply to the Deductible, however they do apply towards the Out of Pocket Maximum

8