Page 319 - GMAT 2017b_Neatb

P. 319

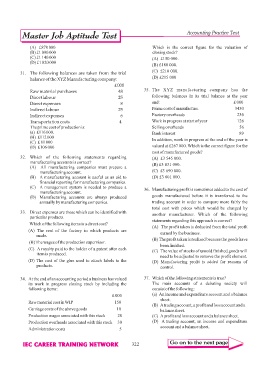

Accounting Practice Test

(A) £870 000 Which is the correct figure for the valuation of

(B) £1 090 000 closing stock?

(C) £1 140 000 (A) £150 000.

(D) £1 020 000

(B) £180 000.

(C) £210 000.

31. The following balances are taken from the trial

balance of the XYZ Manufacturing company: (D) £215 000

£ 000

Raw material purchases 48 35. The XYZ manufacturing company has the

Direct labour 25 following balances in its trial balance at the year

Direct expenses 8 end: £ 000

Indirect labour 25 Prime cost of manufacture 3450

Indirect expenses 6 Factory overheads 236

Transportation costs 4 Work in progress at start of year 126

The prime cost of production is: Selling overheads 56

(a) £116 000. Bank interest 89

(B) £112 000 In addition, work in progress at the end of the year is

(C) £ 81 000

(D) £106 000 valued at £267 000. Which is the correct figure for the

cost of manufactured goods?

32. Which of the following statements regarding (A) £3 545 000.

manufacturing accounts is correct?

(B) £3 831 000.

(A) All manufacturing companies must prepare a

manufacturing account. (C) £3 690 000.

(B) A manufacturing account is useful as an aid to (D) £3 601 000.

financial reporting for manufacturing companies.

(C) A management system is needed to produce a 36. Manufacturing profit is sometimes added to the cost of

manufacturing account.

(D) Manufacturing accounts are always produced goods manufactured before it is transferred to the

annually by manufacturing companies. trading account in order to compare more fairly the

total cost with prices which would be charged by

33. Direct expenses are those which can be identified with another manufacturer. Which of the following

particular products.

statements regarding this approach is correct?

Which of the following items is a direct cost?

(A) The profit taken is deducted from the total profit

(A) The rent of the factory in which products are earned by the business.

made.

(B) The profit taken is realized because the goods have

(B) The wages of the production supervisor.

been finished.

(C) A royalty paid to the holder of a patent after each (C) The value of stocks of unsold finished goods will

item is produced.

need to be adjusted to remove the profit element.

(D) The cost of the glue used to attach labels to the (D) Manufacturing profit is added for reasons of

products.

control.

34. At the end of an accounting period a business has valued 37. Which of the following statements is true?

its work in progress closing stock by including the The main accounts of a debating society will

following items: consist of the following:

£ 000 (a) An income and expenditure account and a balance

sheet.

Raw material cost in WIP 150

(B) A trading account, a profit and loss account and a

Carriage costs of the above goods 10 balance sheet.

Production wages associated with this stock 20 (C) A profit and loss account and a balance sheet.

Production overheads associated with this stock 30 (D) A trading account, an income and expenditure

account and a balance sheet.

Administration costs 5

322