Page 324 - GMAT 2017b_Neatb

P. 324

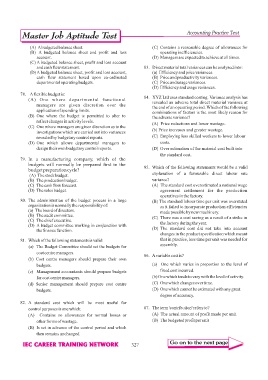

Accounting Practice Test

(A) A budgeted balance sheet. (C) Contains a reasonable degree of allowances for

(B) A budgeted balance sheet and profit and loss operating inefficiencies.

account. (D) Managers are expected to achieve at all times.

(C) A budgeted balance sheet, profit and loss account

and cash flow statement. 83. Direct material total variances can be analysed into:

(D)A budgeted balance sheet, profit and loss account, (a) Efficiency and price variances.

cash flow statement based upon co-ordinated (B) Price and productivity variances.

departmental operating budgets. (C) Price and usage variances.

(D) Efficiency and usage variances.

78. A flexible budget is:

84. XYZ Ltd uses standard costing. Variance analysis has

(A) One where departmental functional

revealed an adverse total direct material variance at

managers are given discretion over the

the end of an operating period. Which of the following

application of spending limits.

combinations of factors is the most likely reason for

(B) One where the budget is permitted to alter to the adverse variance?

reflect changes in activity levels.

(A) Price reductions and lower wastage.

(C) One where managers are given discretion as to the

(b) Price increases and greater wastage.

investigations which are carried out into variances

revealed by budgetary control reports. (C) Employing less skilled workers to lower labour

(D) One which allows departmental managers to costs.

design their own budgetary control reports. (D) Over estimation of the material cost built into

the standard cost.

79. In a manufacturing company, which of the

budgets will normally be prepared first in the

85. Which of the following statements would be a valid

budget preparation cycle?

explanation of a favourable direct labour rate

(A) The stock budget.

(B) The production budget. variance?

(C) The cash flow forecast. (A) The standard cost overestimated a national wage

(D) The sales budget. agreement settlement for the production

operatives in the factory.

80. The administration of the budget process in a large (B) The standard labour time per unit was overstated

organization is normally the responsibility of: as it failed to incorporate production efficiencies

(a) The board of directors. made possible by new machinery.

(B) The audit committee. (C) There was a cost saving as a result of a strike in

(C) The chief executive.

the factory during the year.

(D) A budget committee working in conjunction with

(D) The standard cost did not take into account

the finance function.

changes in the product specification which meant

81. Which of the following statements is valid: that in practice, less time per unit was needed for

assembly.

(a) The Budget Committee should set the budgets for

cost centre managers.

86. A variable cost is?

(b) Cost centre managers should prepare their own

budgets. (a) One which varies in proportion to the level of

(c) Management accountants should prepare budgets fixed cost incurred.

for cost centre managers. (b) One which tends to vary with the level of activity.

(d) Senior management should prepare cost centre (C) One which changes over time.

budgets. (D) One which cannot be estimated with any great

degree of accuracy.

82. A standard cost which will be most useful for

control purposes is one which: 87. The term 'contribution' refers to?

(A) Contains no allowances for normal losses or (A) The actual amount of profit made per unit.

other forms of wastage. (B) The budgeted profit per unit

(B) Is set in advance of the control period and which

then remains unchanged.

327