Page 90 - inside page.cdr

P. 90

AMINES & PLASTICIZERS LTD

sensitive, the same cannot be imported.The Company is thus vulnerable to their price volatility.The Company has

been taking every possible step in order to mitigate the effects of unstable global conditions through reaching out to

new customers, exploring new chemical markets and constant efforts by its R&D Team in developing unique and

innovative Specialty products which have higher margins,to suit its customer needs.As regards fluctuations in Forex,

the Company has natural hedging between exports and imports.The Management encourages the concept of“One

Team” and constantly through its Division / Functional Heads initiate interaction with staff to understand their

concernsandseektheirsuggestionsforimprovingworkingenvironment.

INTERNALCONTROLSYSTEM :

The Company has a proper internal control mechanism, keeping in mind the size and nature of the business. The

Company follows procedures,systems,policies and processes to ensure accuracy in financial information recording,

optimum use of resources and compliance with statutes and laws.The Company conducts its internal audit through

Mr.Niranajan J.Mehtani,Chartered Accountant,Mumbai who regularly monitors the operations and his observations

and recommendations are discussed with the Management. The internal audit team independently reviews and

strengthens the control measures. The Company being into chemical segment also gives strong emphasis to

environmentalprotectionmeasures.

HUMANRESOURCEMANAGEMENT :

The Company believes that employees at all levels are the most critical element, responsible for the growth of the

Company. It ensures a safe, conducive and productive work environment across all its work place. The Company

provides regular skill and personnel development training to enhance employee productivity.The experienced and

talented employee pool plays a key role in enhancing business efficiency,devising strategies,setting-up systems and

evolvingbusinessasperindustryrequirements.EmployeecontributiontotheCompanyhasenabledustomaintainits

leadership position in chemical segment.Nurturing people is a key organisational goal and leadership mandate.The

totalnumberofemployeesonconsolidatedbasisason31March,2019stoodat227.

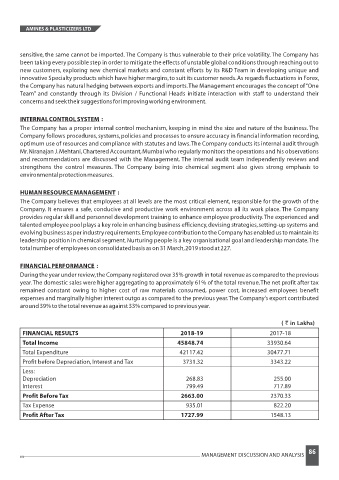

FINANCIALPERFORMANCE :

During the year under review,the Company registered over 35% growth in total revenue as compared to the previous

year.The domestic sales were higher aggregating to approximately 61% of the total revenue.The net profit after tax

remained constant owing to higher cost of raw materials consumed, power cost, increased employees benefit

expenses and marginally higher interest outgo as compared to the previous year.The Company’s export contributed

around39%tothetotalrevenueasagainst33%comparedtopreviousyear.

( ` in Lakhs)

FINANCIAL RESULTS 2018-19 2017-18

Total Income 45848.74 33930 .64

Total Expenditure 42117.42 30477.71

Profit before Depreciation,Interest and Tax 3731.32 3343.22

Less:

Depreciation 268.83 255.00

Interest 799.49 717.89

Profit Before Tax 2663.00 2370.33

Tax Expense 935.01 822.20

Profit After Tax 1727.99 1548.13

86

MANAGEMENT DISCUSSION AND ANALYSIS