Page 10 - ANTILLIAANSE DAGBLAD

P. 10

10 ADVERTENTIE Antilliaans Dagblad Woensdag 12 april 2017

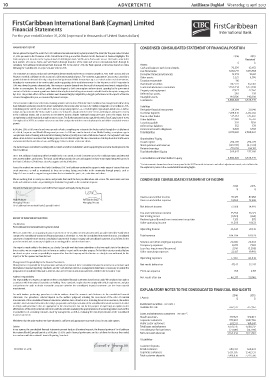

FirstCaribbean International Bank (Cayman) Limited

Financial Statements

For the year ended October 31, 2016 (expressed in thousands of United States dollars)

MANAGEMENT REPORT CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

We are pleased to report the results for FirstCaribbean International Bank (Cayman) Limited (“the Bank”) for the year ended October

31, 2016 pursuant to the Provisions of the Central Bank of Curaçao and Sint Maarten for the Disclosure of Financial Highlights. The 2016 2015

Bank comprises of branches in the Cayman Islands, British Virgin Islands, Sint Maarten, Aruba and Curacao. The Bank is active in the Restated *

local markets of Curacao, Aruba and Sint Maarten through branches of the Bank and services international clients through its $ $

subsidiary FirstCaribbean International Bank (Curacao) N.V. At the end of 2016 the Bank opened a full service branch in Aruba Assets

ğŲŕŕŲǩńťĭƻƾĿĈƻĈƩƾâŕńƩĿŠĈťƾƻŲğƻƻƢĈƊƢĈƩĈťƾƾńǨĈƻŲğĠìĈƻńťƻnjǹżġƐ Cash and balances with Central Banks 70,399 62,652

Due from banks 1,030,771 1,013,555

The economies in Curacao, Aruba and Sint Maarten demonstrated modest to no economic growth in 2016. Both Curacao and Sint ÄŝĀǦŹĀǦÄŶÜġġ¨ĀđŶĀġŤŹŝƋĜÄġŹŤ 12,393 13,261

EƢƾĈťƻƢĈìŲƢüĈüƻƻüĈĦƾńŲťƻŲťƻƾĿĈƻììŲǒťƾƻŲğƻƻğŕŕƻńťƻńťƾĈƢťƾńŲťŕƻŲńŕƻƊƢńìĈƩƐƻdĿĈƻĈìŲťŲŠńìƻƩƾĭťƾńŲťƻńťƻ ǒƢìŲƻǩƩƻìǒƩĈüƻâǯƻƻ Other assets 5,325 6,590

growth in domestic demand offset by a drop in net foreign demand. Public demand was up as a result of an increase in investments, Taxation recoverable 116 –

including the construction of the new hospital and the upgrading of the road infrastructure. In Sint Maarten, real GDP expansion in Investment securities 642,517 652,167

2016 was driven by private demand only. The increase in private demand was the result of increased investments mitigated by a Loans and advances to customers 1,650,634 1,633,618

decline in consumption. By contrast, public demand dropped as both consumption and investment spending by the government

ìŲťƾƢìƾĈüƐƻ0ťƻ ƢǒâƻĈìŲťŲŠńìƻĭƢŲǩƾĿƻǩƩƻŕńŠńƾĈüƻüƢńǨĈťƻâǯƻƾĿĈƻńťƾĈťüĈüƻŕƢĭĈƻńťǨĈƩƾŠĈťƾƻƾŲƻƢĈâǒńŕüƻƾĿĈƻŲńŕƻƢĈĠťĈƢǯƻńťƾŲƻťƻǒƊĭƢüĈƢƻ Property and equipment 27,327 22,562

by CITGO. The positive effects of these activities were however largely mitigated by a sluggish performance in the exports of tourism Deferred tax assets 240 238

services throughout the year, as measured by tourism receipts. Intangible assets 140,806 140,806

Total assets 3,580,528 3,545,449

These economic realities have affected our banking activities and results in 2016 in the Dutch Caribbean but management believes they

ĿǨĈƻüĈŕńǨĈƢĈüƻƩƾńƩğìƾŲƢǯƻƢĈƩǒŕƾƩƻğŲƢƻŕŕƻŲǒƢƻƩƾŒĈĿŲŕüĈƢƩƐƻFĈƾƻńťìŲŠĈƻğƾĈƢƻƾǮƻǩƩƻĄĨƶƐĨƻŠńŕŕńŲťƻìŲŠƊƢĈüƻƾŲƻĄġǹƐżƻŠńŕŕńŲťƻńťƻnjǹżġƐƻƻ Liabilities

Contributing to the current year results were; increase in operating expenses as a result of higher regional operational costs as well as ÄŝĀǦŹĀǦÄŶÜġġ¨ĀđŶĀġŤŹŝƋĜÄġŹŤŶ 29,394 33,040

outlays on expansion into the Aruba market; an increase in loan loss impairment due to the extent and timing of anticipated recovery Customer deposits 2,418,636 2,212,566

in the Caribbean region; and an increase in net interest income, despite continued margin pressures across the region, due to Due to other banks 595,163 720,402

strengthening credit demand and an uplift in interest rates. The Bank maintained strong capital levels with a Total Capital ratio of 16.4%. Other liabilities 22,988 16,745

The emphasis for 2017 is to continue to focus on our clients and put them in the center of what we do and deliver sustainable revenue

growth. Taxation payable 320 1,156

Deferred tax liabilities 352 378

In October 2016, a full service branch was opened in Aruba, completing our entry into the Aruba market through the establishment ZÄŹĀŝÄĜÄġŹŶÄġÄÜŹŶĮđĀéŹĀĮġŤ 3,828 3,782

of a Retail, Corporate and Wealth Management presence. In 2016 we saw the launch of our Mobile Banking smartphone app to Total liabilities 3,070,681 2,988,069

complement internet banking and Automated Banking Machines (ABMs) in our suite of alternate channels. This expanded suite now

ŕŕŲǩƩƻìŕńĈťƾƩƻƾŲƻâĈƾƾĈƢƻìǒƩƾŲŠńƩĈƻƾĿĈńƢƻâťŒńťĭƻĈǮƊĈƢńĈťìĈƻƾŲƻĠƾƻƾĿĈńƢƻŕńğĈƩƾǯŕĈƐƻuĈƻŕƩŲƻƢĈťŲǨƾĈüƻŲǒƢƻ ŲŕĈƻ ǯƻâƢťìĿƻńťƻSint Maarten Shareholders' Equity

and converted that branch into a Loan and Mortgage Center to better service our clients. Issued capital 294,789 294,789

Share premium and reserves (40,000) (43,590)

The Bank remains committed to working with our clients and other stakeholders and in supporting the economic development in the Retained earnings 255,058 306,181

Dutch Caribbean.

Total shareholders’ Equity 509,847 557,380

0 ƻ'ńƢƩƾ ƢńââĈťƟƩƻğǒťüƢńƩńťĭƻĈğğŲƢƾƻğŲƢƻuŕŒƻğŲƢƻƾĿĈƻ ǒƢĈƻƢńƩĈüƻƻƢĈìŲƢüƻĄġǹǹ÷ǹǹǹƻìƢŲƩƩƻƾĿĈƻ ƢńââĈťƻƢĈĭńŲťƻťüƻƾƾƢìƾĈüƻ

over 20,000 walkers and runners. The funds raised will go towards the care and support for those in our region living with cancer. In Total Liabilities and Shareholders' Equity 3,580,528 3,545,449

the Dutch Caribbean $39,000 was raised to support such local initiatives.

ÄŝŹĀġŶĜĮƋġŹŤŶŤûĮǧġŶûÄŝÄŶ¸ĮŶġĮŹŶ¨ĮŝŝÄŤŅĮġ¸ŶŹĮŶŹûÄŶƆǷĸÝŶÜġġ¨ĀđŶŤŹŹÄĜÄġŹŤŶġ¸ŶŝÄâĨŹŶ¸ČƋŤŹĜÄġŹŤŶĜ¸Ä³ŶŝÄÛÄŝŶŹĮŶFĮŹÄŶäŶĀġŶ

Across the markets we serve in the Dutch Caribbean, CIBC FirstCaribbean continued to support a wide range of causes that raise the ÄǬŅđġŹĮŝǭŶġĮŹÄŤŶŹĮŶŹûÄŶ¨ĮġŤĮđĀ¸ŹÄ¸ŶÜġġ¨ĀđŶûĀéûđĀéûŹŤŋ

social awareness, as well as maintained its focus on creating lasting social value in the community through projects such as

Adopt-A-Cause as well as support to organisations that are involved in sports, arts, education and culture.

We are working hard to satisfy our clients and provide them with the best possible advice and service. The investments we have CONDENSED CONSOLIDATED STATEMENT OF INCOME

made and continue to make are positioning the institution for growth as the economies improve.

2016 2015

We wish to thank our customers and staff for their support and loyalty during the year.

$ $

_________________________ _________________________ Interest and similar income 92,129 87,658

Mark McIntyre Pim van der Burg Interest and similar expense 14,563 12,665

Managing Director Managing Director

FirstCaribbean International Bank (Cayman) Limited Net interest income 77,566 74,993

Fee and Commission income 15,558 16,373

Net trading losses (1,254) (263)

REPORT OF INDEPENDENT AUDITORS

Realised gains/(losses) from investment securities 1,129 (97)

Other operating income 11,205 10,123

The Directors

FirstCaribbean International Bank (Cayman) Limited

Operating income 26,638 26,136

uĈƻĿǨĈƻǒüńƾĈüƻƾĿĈƻììŲŠƊťǯńťĭƻĠťťìńŕƻƩƾƾĈŠĈťƾƩƻŲğƻ'ńƢƩƾ ƢńââĈťƻ0ťƾĈƢťƾńŲťŕƻ ťŒƻƌ ǯŠťƍƻ?ńŠńƾĈüƻƌƾĿĈƻ ťŒƍƻǩĿńìĿƻ

ìŲŠƊƢńƩĈƻƾĿĈƻìŲťƩŲŕńüƾĈüƻƩƾƾĈŠĈťƾƻŲğƻĠťťìńŕƻƊŲƩńƾńŲťƻƩƻŲğƻKìƾŲâĈƢƻǃż÷ƻnjǹżƶ÷ƻƾĿĈƻìŲťƩŲŕńüƾĈüƻƩƾƾĈŠĈťƾƻŲğƻńťìŲŠĈ÷ƻìŲťƩŲŕńüƾĈüƻ Total revenue 104,204 101,129

ƩƾƾĈŠĈťƾƻŲğƻìŲŠƊƢĈĿĈťƩńǨĈƻńťìŲŠĈ÷ƻìŲťƩŲŕńüƾĈüƻƩƾƾĈŠĈťƾƻŲğƻìĿťĭĈƩƻńťƻĈƗǒńƾǯƻťüƻìŲťƩŲŕńüƾĈüƻƩƾƾĈŠĈťƾƻŲğƻìƩĿƻĦŲǩƩƻğŲƢƻƾĿĈƻ

ǯĈƢƻƾĿĈťƻĈťüĈü÷ƻťüƻƻƩǒŠŠƢǯƻŲğƻƩńĭťńĠìťƾƻììŲǒťƾńťĭƻƊŲŕńìńĈƩƻťüƻƾĿĈƻƢĈŕƾĈüƻťŲƾĈƩƐ Salaries and other employee expenses 23,600 22,063

Occupancy expenses 8,374 7,982

This report is made solely to the directors, as a body. Our audit work has been undertaken so that we might state to the directors Loan loss impairment/(recovery) 2,961 (1,200)

those matters we are required to state to them in an auditors’ report and for no other purpose. To the fullest extent permitted by law, Other operating expenses 22,127 19,993

we do not accept or assume responsibility to anyone other than the Company and the directors as a body, for our audit work, for this

report, or for the opinions we have formed.

Operating expenses 57,062 48,838

Management’s Responsibility for the Financial Statements

EťĭĈŠĈťƾƻńƩƻƢĈƩƊŲťƩńâŕĈƻğŲƢƻƾĿĈƻƊƢĈƊƢƾńŲťƻťüƻğńƢƻƊƢĈƩĈťƾƾńŲťƻŲğƻƾĿĈƩĈƻìŲťƩŲŕńüƾĈüƻĠťťìńŕƻƩƾƾĈŠĈťƾƩƻńťƻììŲƢüťìĈƻǩńƾĿƻ Net result before tax 47,142 52,291

International Financial Reporting Standards, and for such internal control as management determines is necessary to enable the

ƊƢĈƊƢƾńŲťƻŲğƻìŲťƩŲŕńüƾĈüƻĠťťìńŕƻƩƾƾĈŠĈťƾƩƻƾĿƾƻƢĈƻğƢĈĈƻğƢŲŠƻŠƾĈƢńŕƻŠńƩƩƾƾĈŠĈťƾƩ÷ƻǩĿĈƾĿĈƢƻüǒĈƻƾŲƻğƢǒüƻŲƢƻĈƢƢŲƢƐƻ XŝĮÜŹŶŹǬŶÄǬŅÄġŤÄ 765 2,151

Auditors’ Responsibility Net result after tax 46,377 50,140

KǒƢƻƢĈƩƊŲťƩńâńŕńƾǯƻńƩƻƾŲƻĈǮƊƢĈƩƩƻťƻŲƊńťńŲťƻŲťƻƾĿĈƩĈƻìŲťƩŲŕńüƾĈüƻĠťťìńŕƻƩƾƾĈŠĈťƾƩƻâƩĈüƻŲťƻŲǒƢƻǒüńƾƐƻuĈƻìŲťüǒìƾĈüƻŲǒƢƻǒüńƾƻńťƻ

accordance with International Standards on Auditing. Those standards require that we comply with ethical requirements and plan

ťüƻ ƊĈƢğŲƢŠƻƾĿĈƻ ǒüńƾƻƾŲƻ Ųâƾńťƻ ƢĈƩŲťâŕĈƻ ƩƩǒƢťìĈƻǩĿĈƾĿĈƢƻƾĿĈƻ ìŲťƩŲŕńüƾĈüƻ Ġťťìńŕƻ ƩƾƾĈŠĈťƾƩƻ ƢĈƻ ğƢĈĈƻ ğƢŲŠƻ ŠƾĈƢńŕƻ

misstatement.

EXPLANATORY NOTES TO THE CONSOLIDATED FINANCIAL HIGHLIGHTS

ťƻ ǒüńƾƻ ńťǨŲŕǨĈƩƻ ƊĈƢğŲƢŠńťĭƻ ƊƢŲìĈüǒƢĈƩƻƾŲƻ Ųâƾńťƻ ĈǨńüĈťìĈƻ âŲǒƾƻƾĿĈƻ ŠŲǒťƾƩƻ ťüƻ üńƩìŕŲƩǒƢĈƩƻ ńťƻƾĿĈƻ ìŲťƩŲŕńüƾĈüƻ Ġťťìńŕƻ 2016 2015

statements. The procedures selected depend on the auditors’ judgment, including the assessment of the risks of material I. Assets $ $

ŠńƩƩƾƾĈŠĈťƾƻŲğƻƾĿĈƻìŲťƩŲŕńüƾĈüƻĠťťìńŕƻƩƾƾĈŠĈťƾƩ÷ƻǩĿĈƾĿĈƢƻüǒĈƻƾŲƻğƢǒüƻŲƢƻĈƢƢŲƢƐƻ0ťƻŠŒńťĭƻƾĿŲƩĈƻƢńƩŒƻƩƩĈƩƩŠĈťƾƩ÷ƻƾĿĈƻǒüńƾŲƢƻ

ìŲťƩńüĈƢƩƻńťƾĈƢťŕƻìŲťƾƢŲŕƻƢĈŕĈǨťƾƻƾŲƻƾĿĈƻĈťƾńƾǯƞƩƻƊƢĈƊƢƾńŲťƻťüƻğńƢƻƊƢĈƩĈťƾƾńŲťƻŲğƻƾĿĈƻìŲťƩŲŕńüƾĈüƻĠťťìńŕƻƩƾƾĈŠĈťƾƩƻńťƻŲƢüĈƢƻ Investment securitiesƻŃƻƩĈĈƻťŲƾĈƻġ

to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the Available for sale 642,517 652,167

effectiveness of the entity‘s internal control. An audit also includes evaluating the appropriateness of accounting policies used and the

reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated Loans and advances to customers -ƻƩĈĈƻťŲƾĈƻġ

ĠťťìńŕƻƩƾƾĈŠĈťƾƩƐ

Retail Customers 497,527 470,814

uĈƻâĈŕńĈǨĈƻƾĿƾƻƾĿĈƻǒüńƾƻĈǨńüĈťìĈƻǩĈƻĿǨĈƻŲâƾńťĈüƻńƩƻƩǒğĠìńĈťƾƻťüƻƊƊƢŲƊƢńƾĈƻƾŲƻƊƢŲǨńüĈƻƻâƩńƩƻğŲƢƻŲǒƢƻǒüńƾƻŲƊńťńŲťƐ Corporate customers 979,457 1,007,756

Public sector customers 201,531 189,647

Opinion Total loans and advances 1,678,515 1,668,217

0ťƻŲǒƢƻŲƊńťńŲť÷ƻƾĿĈƻìŲťƩŲŕńüƾĈüƻĠťťìńŕƻƩƾƾĈŠĈťƾƩƻƊƢĈƩĈťƾƻğńƢŕǯ÷ƻńťƻŕŕƻŠƾĈƢńŕƻƢĈƩƊĈìƾƩ÷ƻƾĿĈƻĠťťìńŕƻƊŲƩńƾńŲťƻŲğƻ'ńƢƩƾ ƢńââĈťƻ Less allowance for loan losses (27,881) (34,599)

0ťƾĈƢťƾńŲťŕƻ ťŒƻƌ ǯŠťƍƻ?ńŠńƾĈüƻƩƻŲğƻKìƾŲâĈƢƻǃż÷ƻnjǹżƶ÷ƻťüƻńƾƩƻĠťťìńŕƻƊĈƢğŲƢŠťìĈƻťüƻńƾƩƻìƩĿƻĦŲǩƩƻğŲƢƻƾĿĈƻǯĈƢƻƾĿĈťƻĈťüĈüƻ Net Loans and advances 1,650,634 1,633,618

in accordance with International Financial Reporting Standards.

II. Liabilities

Customer deposits

December 23, 2016 Retail customers 698,331 669,833

Corporate customers 1,720,305 1,542,733

Total customer deposits 2,418,636 2,212,566