Page 20 - Bullion World Issue 1 May 2021

P. 20

Bullion World | Issue 01 | May 2021

NSE Gold Mini Options:

Redefining Gold

Hedging

NSE is the World’s largest derivatives investors. These advantages are not just

exchange and the market leader in terms of the cost of trading but also in

across various asset classes traded terms of the trading flexibility offered by

in the domestic markets. With this the characteristics of Options on goods Mr Nagendra Kumar

rich experience gained from the other contracts. NSE

segments, NSE embarked on its journey

in commodity derivatives in the month Many of the Jewellers and Bullion players

of Oct 2018 by introducing commodity have already optimised their hedging “ The Open Interest (OI)

futures contracts on Gold and Silver. by adding options to their books. This is in gold options contracts

evident from the healthy Open interest

NSE has launched the Gold Mini Options (the number of outstanding contracts on NSE had touched a

contracts on 8th of June 2020 and awaiting settlement), which is considered high of 7041 contracts

the journey can be summarised in a as one of the best barometers to assess with an average OI

single word ‘Innovation”. The launch of the performance of a derivative contract. of 3463 contracts and

the Gold options contract on NSE has The Open Interest (OI) in gold options

brought in new dimension to the way contracts on NSE had touched a high volumes hovering at

Gold is being Hedged. The physically of 7041 contracts with an average OI of a monthly average of

settled options Contract based on the 3463 contracts and volumes hovering at 46345 contracts, since

underlying commodity, with a small lot a monthly average of 46345 contracts,

size of 100 grams, offers some unique since the commencement of the the commencement of

advantages to the entire value chain contract. the contract. ”

participants as well as to the retail

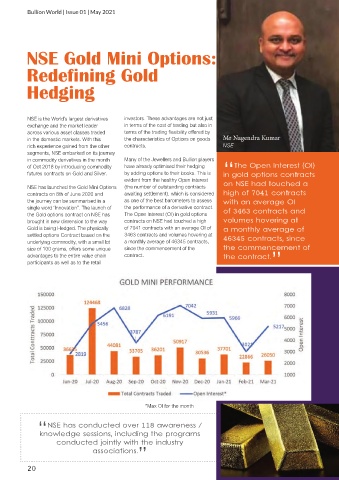

*Max OI for the month

“ NSE has conducted over 118 awareness /

knowledge sessions, including the programs

conducted jointly with the industry

associations. ”

20