Page 34 - Bullion World Issue 7 November 2021

P. 34

Bullion World | Issue 07 | November 2021

A glimpse at Let us take a complete example of

how to proceed with option trading

in for e.g. gold.

analyzing and using E.g.: A jeweler has received

Gold option chain a contract for jewellery which

requires 100 grams of gold. This

contract has been based on the

cost of gold at 47400 rupees per

10 grams. The jeweler needs

The use of options allows the to manufacture and deliver the

precious metals supply chain jewellery by November 20. The

participants to hedge their price jeweler will purchase this gold by

risks. It also allows speculators with Nov 5. The date when the contract

a directional view to take positions was entered was Oct 1. The risk

on the commodities derivatives faced by jeweler is that of gold

exchanges. In a nutshell, an option prices rising above the 47400

on an underlying (for e.g. gold or rupees level. If this happens it is

silver) gives the participant the right likely to add to the cost of raw

to buy or sell at an agreed price for material for jewellery manufacture

a defined period of time. The buyer as well as reduce the profit margin.

of the call (with a bullish view on

underlying) has the right but not the As the jeweler expects the cost

Ms Ashwini Bansod obligation to buy the underlying at of underlying gold to increase in

Head Commodities Research, an agreed price in a defined time. November, he decides to buy gold

Similarly a put option buyer (with a options on domestic exchange for

PhillipCapital (India) Pvt. Ltd.

bearish view on underlying) has the e.g. on MCX, to manage the risk. To

right but not the obligation to sell do this he at the outset looks at the

the underlying asset at an agreed prevailing option chain (Chart 1) for

price for a defined time. gold for November expiry contract.

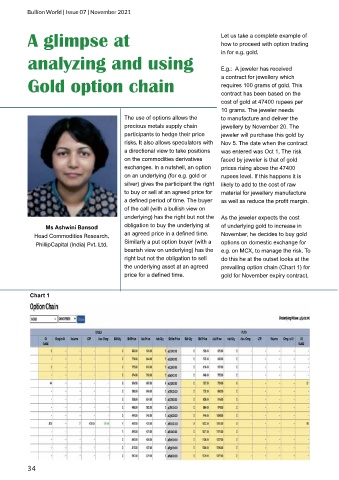

Chart 1

34