Page 3 - Test

P. 3

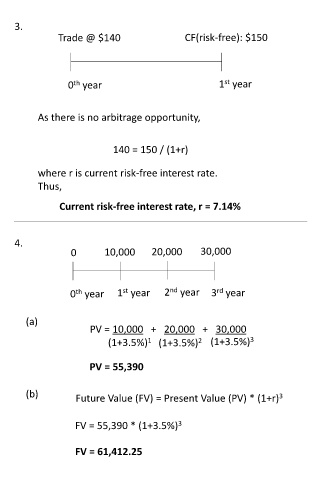

3.

Trade @ $140 CF(risk-free): $150

st

th

0 year 1 year

As there is no arbitrage opportunity,

140 = 150 / (1+r)

where r is current risk-free interest rate.

Thus,

Current risk-free interest rate, r = 7.14%

4.

0 10,000 20,000 30,000

nd

st

rd

th

0 year 1 year 2 year 3 year

(a)

PV = 10,000 + 20,000 + 30,000

1

(1+3.5%) (1+3.5%) 2 (1+3.5%) 3

PV = 55,390

(b) Future Value (FV) = Present Value (PV) * (1+r) 3

FV = 55,390 * (1+3.5%) 3

FV = 61,412.25