Page 7 - Test

P. 7

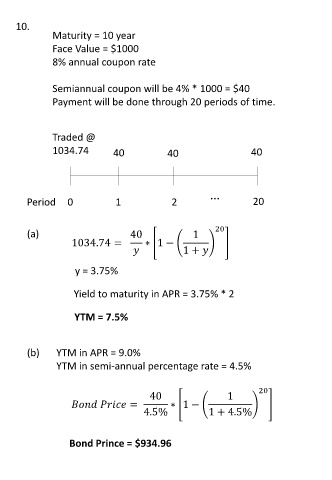

10.

Maturity = 10 year

Face Value = $1000

8% annual coupon rate

Semiannual coupon will be 4% * 1000 = $40

Payment will be done through 20 periods of time.

Traded @

1034.74 40 40 40

…

Period 0 1 2 20

20

(a) 40 1

1034.74 = ∗ 1 −

1 +

y = 3.75%

Yield to maturity in APR = 3.75% * 2

YTM = 7.5%

(b) YTM in APR = 9.0%

YTM in semi-annual percentage rate = 4.5%

20

40 1

= ∗ 1 −

4.5% 1 + 4.5%

Bond Prince = $934.96