Page 21 - CPB March 21st

P. 21

Society (or in the event that such index shall cease to exist or is subject to any material change any other similar index in the absolute discretion of Shaw Insurance) which is payable within six months of the date of your death.

The charge structure has been devised in a manner to simplify charges to the customer. Shaw Insurance Limited’s 5% set up fee is intended to cover third-party charges of the nature listed below:

• conveyancing/legal fees,

• insurance on standard property searches

prior to the purchase of a property,

• Stamp Duty Land Tax payable at the time

of the swap,

• SDLT submission fee to the Land Registry,

• mortgage arrangement fee to the lender of Shaw Insurance Limited,

• market condition and survey report fee and other related charges for the work carried out by a third-party property manager in the UK to assess the viability of the property prior to the swap of the Care Property Bond,

• property owners insurance premium and other property-related charges.

Most of the above charges should be compared with the main alternative of an immediate sale of the property in the open market, save for the discount that may have been necessarily applied to the asking price to speed the sale of the property.

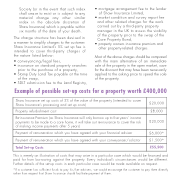

Example of possible set-up costs for a property worth £400,000

Shaw Insurance set up costs of 5% of the value of the property (intended to cover Shaw Insurance’s processing and set up costs)

£20,000

Property refurbishment cost

£8,000

Re-insurance Premium (as Shaw Insurance will only borrow up to five years’ income payments to be made to a care home, it will take out re-insurance to cover the risk of making income payments after 5 years)

£20,000

Payment of remuneration which you have agreed with your financial adviser

£6,000*

Payment of remuneration which you have agreed with your conveyancer/solicitor

£1,500*

Total Set-up Costs

£55,500

This is merely an illustration of costs that may arise in a particular case which would be financed and paid for from borrowing against the property. Every individual’s circumstances would be different. Further details of the set-up costs in each particular case would be made available on request.

*If a customer has sufficient funds to pay his/her advisers, we would encourage the customer to pay them directly rather than request that Shaw Insurance should facilitate payment of them.