Page 540 - B2B all year round_UPDATE 5

P. 540

15년 하반기 LGE CHI향 ISSUE 관련

■ Market Trend

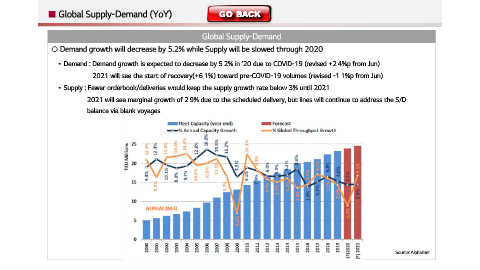

Post COVID-19 – Changes in S/D balance and Rate Dynamics

Unit : TEU

<Correlation between LB import volume and capacity>

350,000 100,000

Demand Supply Index

Year Month

(Wkly avg) (avg) (Jan=1.0) 90,000

’20 Jan 77,490 271,921 1.00 300,000 Jan=1.0

80,000

’20 Feb 62,148 174,052 1.25

’20 Mar 58,643 263,094 0.78 250,000 70,000

’20 Apr 63,385 221,970 1.00

60,000

’20 May 78,148 234,242 1.17 200,000

’20 Jun 75,179 254,372 1.04 Exceed demand compared to Jan 50,000

Demand

Supply

Wkly Capa (avg.) LBG I/B

’20 Jul 94,202 305,922 1.08 (avg. / Left Axis) (Right

150,000 Axis) 40,000

’20 Aug 94,202(e) 324,400 1.02 Jan Feb Mar Apr May Jun Jul Aug Sep

Market Rate

‘20 Sep 94,202(e) 316,534 1.04 (USWC, per $1,554 $1,417 $1,509 $1,608 $1,798 $2,562 $2,874 $3,373 $4,000(e)

FEU)

* Assuming LGB import volume in Aug. and Sep. is same as in Jul. Supply adjustment Demand increase > Supply increase

[Background for Transpacific E/B Rate rise in 2H] [Supply/Demand forecast(Short/Mid term)]

• The extra capacity injection was not sufficient enough to cover

the demand recovery

Demand accumulated since Apr. surpassed supply range Demand Supply

• Continued demand increase while US GDP decrease 31.7% in 2Q

Steady demand due to daily necessity and revenge shopping Strong demand is expected to Limited supply growth

• Carrier supply discipline with strong bond within Alliance last in the short term Continued artificial supply

Carriers are managing capacity levels in accordance with Strong demand expected adjustment by Carrier

market demand until 3Q