Page 19 - STB_Meade_Final_for_sending

P. 19

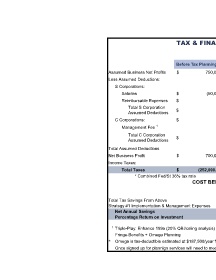

TAX & FINANCIAL ANALYSIS

Before Tax Planning After Tax Planning Annual Savings

Assumed Business Net Profits $ 750,000 $ 750,000

Less Assumed Deductions:

S Corporations:

Salaries $ (50,000) $ (100,000)

Reimbursable Expenses $ - $ (50,000)

Total S Corporation

Assumed Deductions $ - $ (150,000)

C Corporations: $ -

Management Fee 1 $ 450,000

Total C Corporation

Assumed Deductions $ - $ (450,000)

Total Assumed Deductions $ (600,000)

Net Business Profit $ 700,000 $ 150,000

Income Taxes:

(184,500.00)

Total Taxes $ (252,000.00) $ (67,500.00) $

* Combined Fed/St 36% tax rate

COST BENEFIT ANALYSIS

Year 1 Over 5 Years Over 10 Years

(922,500.00) $

Total Tax Savings From Above $ (184,500.00) $ (1,845,000.00)

(150,000.00) $

Strategy #1 Implementation & Management Expenses $ (50,000.00) $ (300,000.00)

Net Annual Savings $ (134,500) $ (772,500) $ (1,545,000)

Percentage Return on Investment 369% 615% 615%

1 Triple-Play: Enhance 199a (20% QBI/celing analysis) + Arbitrage C-corp rates + increase otherwise non-deductible

Fringe-Benefits + Omega Planning

* Omega is tax-deductible estimated at $187,500/year for a 10 yr period. See next Omega Graphic Overview

Once signed up for plannign services will need to medically/financially vet owner.