Page 22 - STB_Meade_Final_for_sending

P. 22

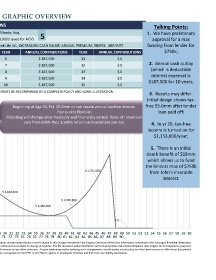

OMEGA RETIREMENT PLAN GRAPHIC OVERVIEW

ASSUMPTIONS Talking Points:

CURRENT AGE: 42 NAME OF INSURED: John Meade, Esq. 1. We have preliminary

RETIREMENT AGE: 52 INITIAL DEATH BENEFIT: 1,800,0000 (used for HCV) 5 approval for a max

LOAN PAY-OFF AGE: 52 1 TYPE OF POLICY: $750k Annual Funding; NLG Peak Life IUL; INCREASING CASH VALUE; ANNUAL PREMIUM; RIDERS: ABR SVEE funding from lender for

YEAR ANNUAL CONTRIBUTIONS YEAR ANNUAL CONTRIBUTIONS YEAR ANNUAL CONTRIBUTIONS $750k;

LOAN INTEREST RATE: 6.91%

1 $ 187,500 6 $ 187,500 11 $ 0

2 2 $ 187,500 7 $ 187,500 12 $ 0 2. Annual cash outlay

EFFECTIVE INCOME TAX RATE: 40% (which is deductible

3 $ 187,500 8 $ 187,500 13 $ 0

interest expense) is

WEIGHTED AVERAGE ANNUAL 4 $ 187,500 9 $ 187,500 14 $ 0

6.91% $187,500 for 10 years;

INTEREST CREDITED RATE: 5 $ 187,500 10 $ 187,500 15 $ 0

THIS GRAPHIC OVERVIEW IS HYPOTHETICAL AND NOT INTENDED TO BE A PROJECTION OF FUTURE VALUES AND MUST BE ACCOMPANIED BY A COMPLETE POLICY AND LOAN ILLUSTRATION.

3. Results may differ.

$ 12,000,000 Initial design shows tax-

3

Beginning at Age 53, Est. $5.6mm or can create annual tax-free income. free $5.6mm after lender

Loan Balance Plan is very flexibile. loan paid off;

(Paid off in Year 10 from CSV) $ 9,265,000 $5.6mm Cash Surrender Value Modeling will change once medically and financially vetted. Rates of return can

$ 10,000,000 vary from 600% thru 1,500% return on investment pre-tax.

@ Yr 10 4. In yr 20, tax-free

Loan Paid off income is turned on for

$1,153,000/year;

$ 8,000,000 $ 5,625,000

5. There is an initial

$ 7,048,000 death benefit of $18mm

which allows us to fund

$ 6,000,000 $ 6,135,000

the lenders max of $750k

$ 4,701,000

from John's insurable

$ 5,125,000 interest.

$ 5,618,000

$ 4,000,000

$ 2,863,000

Cumulative Contributions @ Yr 10

4 $ 1,990,000

$ 2,000,000 $ 1,386,000

$1,153,000/year

$ 937,500 $ 1,875,000

$ 0

$ 0

YEAR

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60

AGE 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90

This Graphic Overview assumes that the collateral will be placed in a separate checking account rather than provide a bank authorized letter of credit. All life insurance illustrations and premium finance models shown in this Omega Retirement Plan Graphic Overview reflects the information contained in the leveraged financing Illustration,

dated April 26, 2018, prepared by advisor team Indexed UL Illustration, dated April 26, 2018 of a possible life insurance policy and loan. Interest rates, fees and other costs are estimated and subject to change at anytime. The life insurance policy illustration and loan projection and related compliant sales ledgers are for illustration purposes

only and should not be considered a recommendation from PTG, its officers, agents or employees. Under no circumstances does this information represent a guarantee of performance or any other outcome. Anyone evaluating and/or entering such arrangements should expect actual policy and loan performance to differ from this graphic

overview. It is the sole responsibility of the individual who relies on this information to seek independent tax, financial, investment or legal advice concerning this policy and loan, and agrees to hold PTG or its officers, agents or employees harmless and free from any liability whatsoever.